Wichita, Kansas LandValuePerAcre

See Discussion page for additional questions that I'm asking about developing this further

Wichita, Kansas Land Value Per Acre Analysis

The idea of creating a land value per acre map for Wichita, Kansas and Sedgwick County interests us. We are going to use this process described in the How-to documentation.

Overview

One way to examine the utilization and value of the land use in your community is to create a Total Value Per Acre (TVPA) analysis for your town. The idea is that various areas of your city, town or county contribute to the property tax roll at different rates. Sometimes this contribution is obvious; an undeveloped one-acre parcel of land contributes less tax than a one-acre parcel of developed land. Sometimes the contributions are counterintuitive. A 2-acre property with a two million dollar home might contribute less to the property tax roll than if there were 10 0.2 acre houses on the same property.

The organization Strong Towns has recently popularized the value per acre analysis in a piece that they wrote about Kansas City, scroll down to see the "Value Per Acre" map. In the Kansas City map they note "Where, in modern day Kansas City, is real-estate value most concentrated? We need only map the tax value per acre of properties within city limits to see that Kansas City’s highest-value land uses lie overwhelmingly within the 1910 borders."

Our goal is to create a new layer of "Blocks" where a block is a set of contiguous parcels, usually equal to a city block. For each block we will calculate the area (in acres) of the block, we will compute the sum Total Assessed Value of all of the parcels that make up the block, and lastly we will calculate the (Total Assessed Value / Area) for each block. This value - Total Value Per Acre - will give us an understanding of the relative contribution to the tax roll of each city block. Farmed land will typically have a Total Value Per Acre of < $50,000. The most developed and valuable land will have a Total Value Per Acre of over $500,000. We will then analyze larger trends within the City and look at some examples.

Data and Process

This analysis uses data from the Wichita, Kansas open data site. Specifically we are using the open data parcels found here. The data vintage is noted as "The Dataset is updated in real time as the City or County updates their records", therefore we are considering the vintage of the source data to be November 2025. The initial parcel table for Sedgwick County contains 238315 records and the resulting Blocks table contains 12,348 records.

We will use the following fields from the source data:

- the spatial object for each parcel boundary

- OBJECTID - we will use this to track the unique block as the parcels are aggregated

- TotVal - the total value (land + improvements) in dollars for each parcel

We followed the process identified in the How-To documentation with one addition. The Wichita parcel geometries had a few geometries (~20) that were bad and prevented some spatial operations within QGIS. We chose to process the data with the advanced setting "Skip (Ignore) Features with Invalid Geometries" when performing the Dissolve and "Join Attributes by Location (Summary)" operations.

From the process we created a spatial table for our analysis, WichitaKS_Blocks_WithSummaryData.shp.

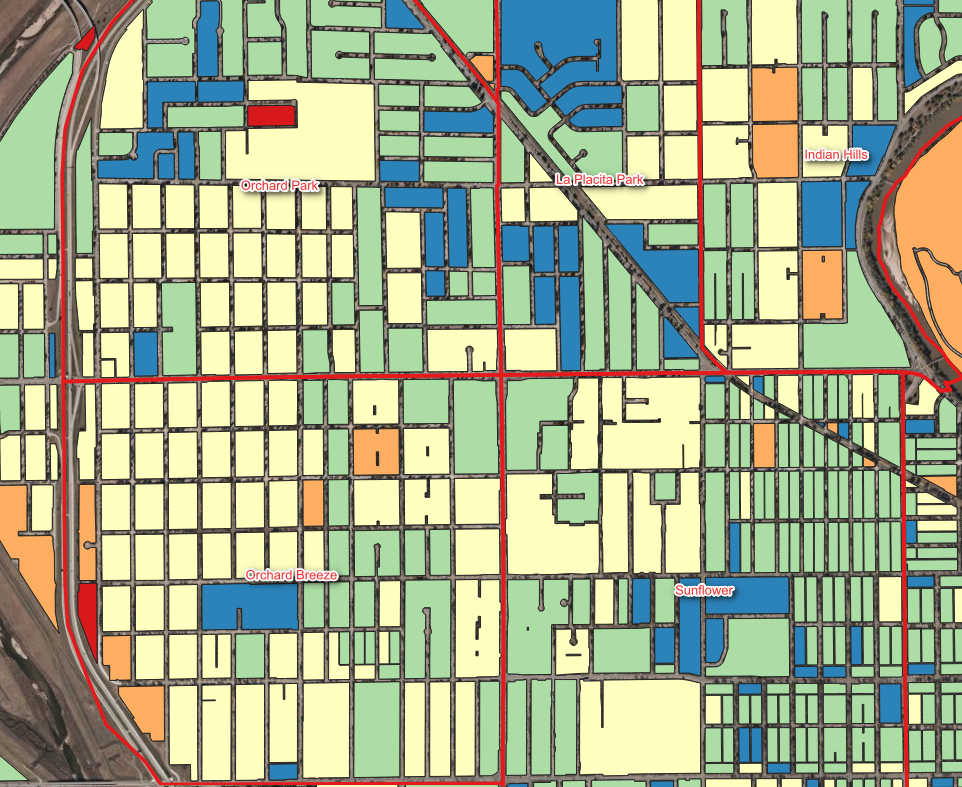

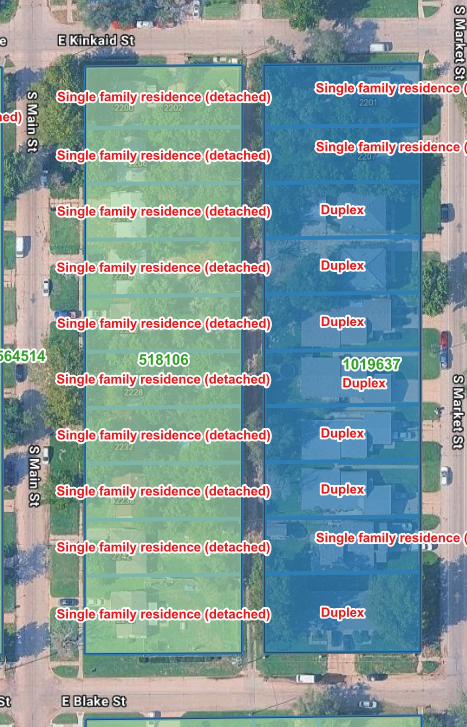

What we end up with are two layers shown in this map - parcel boundaries in brown on the bottom, and block boundaries on the top with no fill and a blue outline, where each block is labeled with its Total Value Per Acre.

Data Downloads

Download the Block data. This is an Esri shape file containing the blocks used in this data story. The shape file, WichitaKS_Blocks_WithSummaryData.shp, has the following structure:

- OBJECTID - a unique ID for each of the 12,348 blocks in the file

- ShapeSTAre - ignore this field

- ShapeSTLen - ignore this field

- AreaAcres - the size of each region object in acres

- TotValAcre - this is the metric used in the maps - (TotVal_Sum / AreaAcres)

- TotVal_Cou - the count of parcels covered by each block

- TotVal_Sum - the sum of the Total Assessed Value of all parcels covered by each block

Big Picture Maps

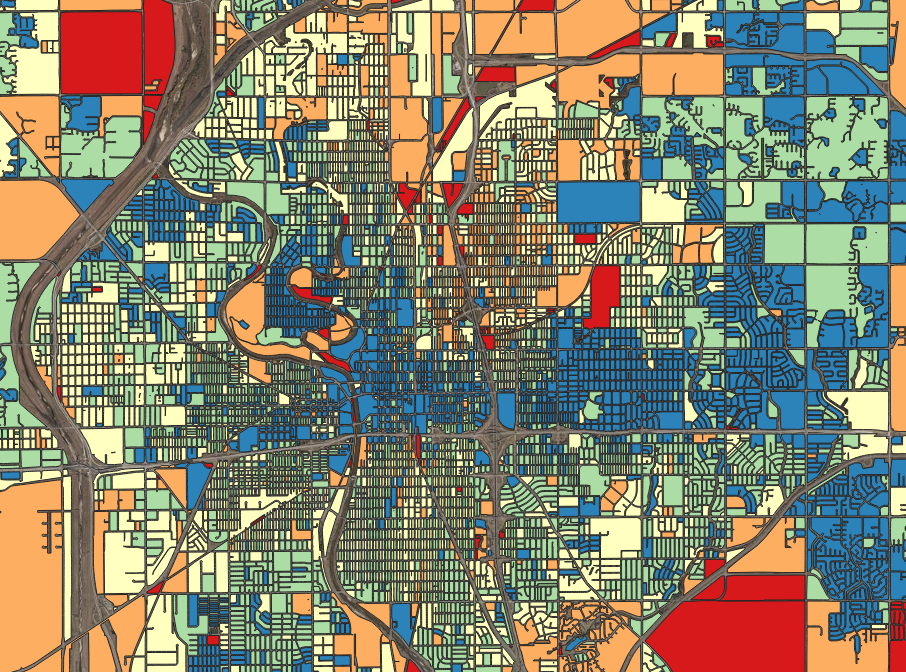

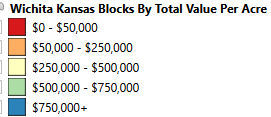

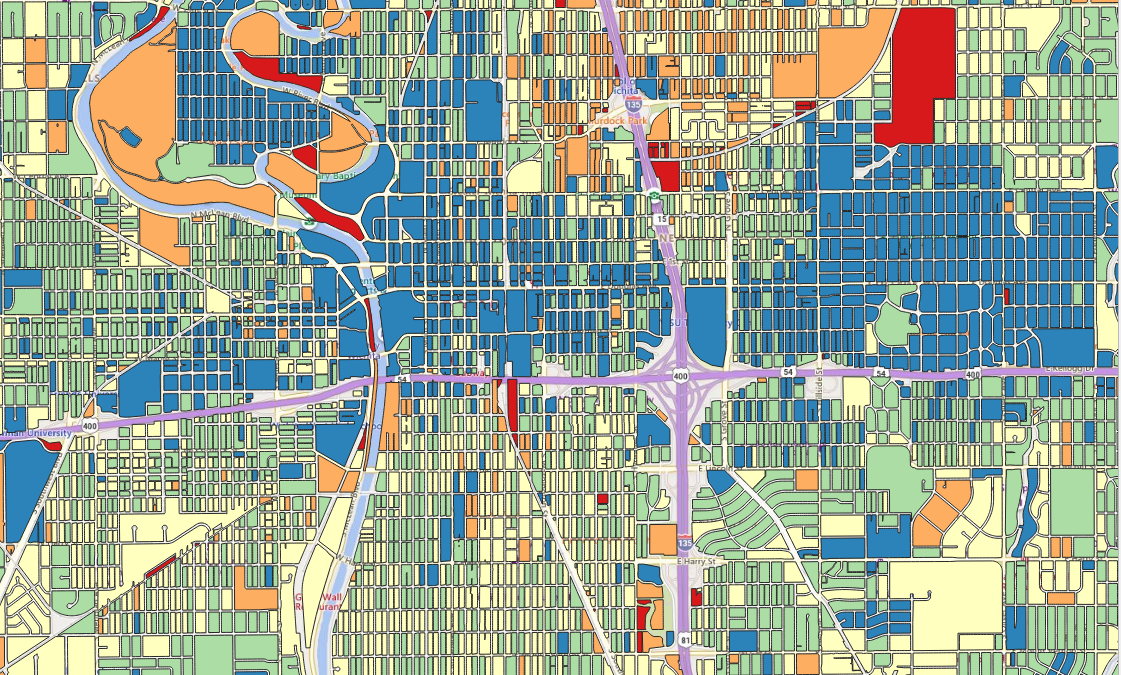

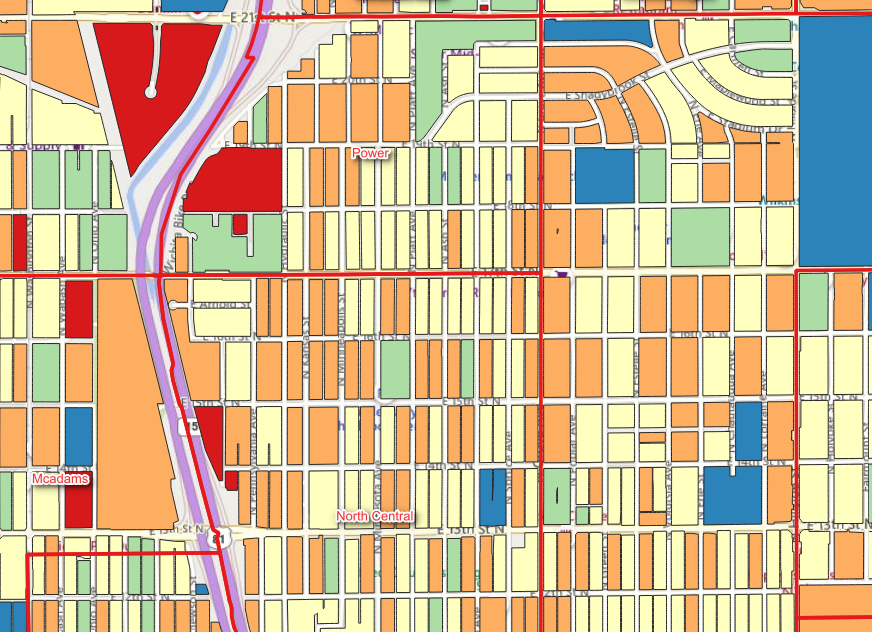

In any of the images below we have created a thematic map that shows each block shaded by Total Value Per Acre. Blocks with the highest value are Blue, blocks with the lowest value are red:

We can start by looking at the value of property north and south of Highway 54. If you are familiar with Wichita, north of Highway 54 are neighborhoods such as Delano, College Hill, and Crown Heights, and each of these neighborhoods consists of Blocks that have higher Total Value Per Acre scores. South of Highway 54 are neighborhoods such as McCormick, Sunnyside and Hilltop-Jefferson that are a mix of Blocks that range between $250k/acre and $750+k/acre in Total Value. South of East Pawnee St the Block values can have values lower than $250k/acre.

Neighborhoods such as Orchard Park, Orchard Breeze and Sunflower are interesting to compare. Housing in these neighborhoods developed between the 1920s and 1950s, however Sunflower has a slightly higher property or parcel density (slightly smaller lots). With more housing more lot, the total assessed value is higher for the same acreage. A typical Block in Sunflower will have a Total Value Per Acre of $600k, while a typical block in Orchard Park or Orchard Breeze will have a TVPA of $400k.

If we look at areas with housing development that occurred in the 1970s, a good sample is in the neighborhoods south of W13th St N. A neighborhood like this has Blocks with high Total Value Per Acre. This housing is relatively new, the lot size is typically around 1/2 to 1/3 of an acre and a significant number of parcels or lots fall on each city block. This leads to Total Value Per Acre by block over $750k and frequently well over $1 million.

Lastly, we can observe neighborhoods such as Power and North Central, each of which have a large number of Blocks that have lower Total Value Per Acre, frequently between $50k and $500k. Heavily built in the 1950s, these neighborhoods have significant numbers of properties that are undeveloped. These lots were never developed, developed then deconstructed, or utilized by adjacent property owners for gardens, parking or other uses. If we think about housing development, these are areas that should be very supportive of infill development which will add housing with no or low infrastructure requirements.

Additional Examples

When we start to look at property from an overall tax yield perspective, we being to notice interesting things. These are some examples.

At E Blake St and S Market St are two city blocks divided by an alleyway. The block to the west has a Total Value per Acre of $518k; the block to the east has a value that twice as high, $1.02 million. Same neighborhood, same property parcel sizes, same number of parcels on each block (about 10). What is the difference? The block on the east is primarily duplexes. Duplexes drive a higher assessed value and you don't need too many of them to drive significantly higher property tax yield. And duplexes are great starter homes. And duplexes add more housing units to the community.

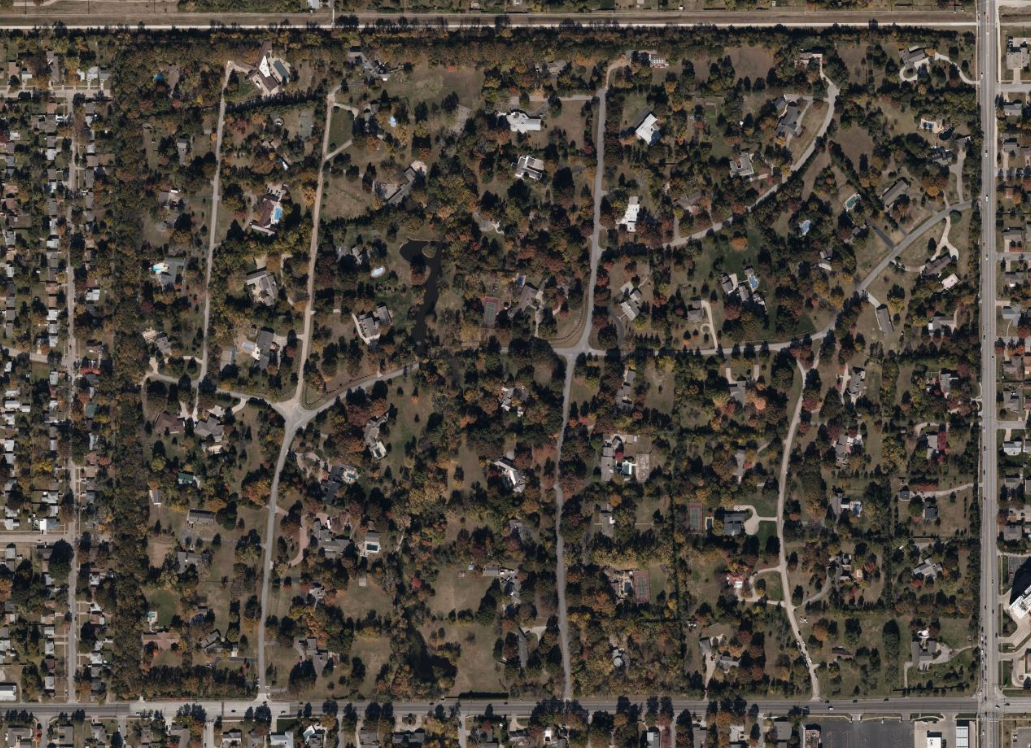

We can look at Total Value Per Acre in affluent areas. Around E 13st St N and N Woodlawn Blvd is an area of upper incomes homes, typically $500-750k homes built between the 1950s and 1970s. These homes have large lot sizes as seen in the picture below.

When we look at Total Value Per Acre, the value is relatively low. Every block has a TVPA of under $300k which is counterintuitive for an affluent area.

Finally, we can study the impact of undeveloped land on Total Value Per Acre for any block. Here are two blocks, divided by an alley at Gilbert and Pershing streets. The western block has a TVPA that is over 1/3 higher than the eastern block. Why? 2 out of 12 parcels that make up the eastern block are undeveloped. The eastern block currently has a Total assessed value of $568 thousand; adding two houses to the two undeveloped parcels would add $150-250k of total assessed value and would bring the TVPA to between $700-$730k, contributing significantly to an increased tax value of this land.

Analyzing Total Value Per Acre by Neighborhood

In our analysis above we use neighborhoods to describe the scenarios and differences in Total Value Per Acre as we looked at various city blocks. Then we wondered what would the data look like if we rolled up our analysis by neighborhood. Using the a neighborhood boundary dataset from Zillow that contains 72 neighborhoods for Wichita, we summed up the Total Value Per Acre analysis by neighborhood. We used QGIS' "Join Attributes by Location (Summary)" tool to compare neighborhood boundaries against blocks, and the acreage and total value were summed for each neighborhood. In addition, we counted how many blocks were found in each neighborhood. Then we added in a Total Value Per Acre value for each neighborhood that is simply (Total Appraised Value of all blocks in the neighborhood / Total acres of all blocks in the neighborhood).

This table is fairly large so click "Expand" to see the entire table. Two values you may want to use for sorting include "Total Value Per Acre" and "Total Appraise Value, All Blocks in Neighborhood". This latter value will let you see the aggregate contribution of each neighborhood to the City's property tax roll. You will notice that neighborhoods can have dramatically different Total Values Per Acre. Residential neighborhoods range from over $1 million to under $200k.

There is no blanket statement that can be made about how bad or good a neighborhood is based on its high or low Total Value Per Acre values. There are many reasons why TVPA could be low for a neighborhood such as a large portion of its property being undeveloped. The TVPA for a neighborhood is a starting point for evaluating the neighborhood's contribution to the property tax roll.

| Name | Number of Blocks | Total Acres, All Blocks in Neighborhood | Total Appraised Value, All Blocks in Neighborhood | Total Value Per Acre |

|---|---|---|---|---|

| Westlink | 19 | 119.766 | $88,890,570 | $742,202 |

| Village | 23 | 110.491 | $85,654,750 | $775,219 |

| Uptown | 73 | 107.093 | $78,655,970 | $734,464 |

| The Elm | 48 | 89.607 | $50,623,030 | $564,945 |

| Sunnyside | 57 | 129.576 | $88,201,230 | $680,691 |

| Sunflower | 215 | 742.582 | $457,603,270 | $616,233 |

| Stanley-Aley | 206 | 751.606 | $324,737,680 | $432,058 |

| Southwest Village | 132 | 1817.954 | $660,439,350 | $363,287 |

| Southwest | 230 | 1598.131 | $871,645,400 | $545,415 |

| South City Community | 127 | 789.999 | $369,294,200 | $467,462 |

| South Central Improvemen | 352 | 831.97 | $417,844,870 | $502,236 |

| South Area | 108 | 1683.356 | $409,668,280 | $243,364 |

| Sleepy Hollow | 18 | 50.223 | $52,831,050 | $1,051,929 |

| Sherwood Glen | 38 | 465.739 | $183,201,340 | $393,356 |

| Schweiter East | 29 | 168.082 | $95,972,750 | $570,988 |

| Schweiter | 16 | 89.844 | $55,739,930 | $620,408 |

| Rockhurst | 6 | 176.393 | $112,473,720 | $637,631 |

| Riverside | 99 | 2866.415 | $490,185,730 | $171,010 |

| Pueblo | 180 | 636.526 | $270,815,370 | $425,458 |

| Power | 53 | 140.784 | $44,849,220 | $318,568 |

| Pleasant Valley | 21 | 407.468 | $153,354,900 | $376,361 |

| Planeview United | 32 | 350.741 | $65,134,150 | $185,704 |

| Park Meadows | 9 | 206.989 | $147,985,790 | $714,945 |

| Orchard Park | 80 | 501.143 | $302,742,720 | $604,104 |

| Orchard Breeze | 84 | 502.086 | $217,992,420 | $434,173 |

| Northwest Big River | 39 | 242.398 | $179,748,600 | $741,543 |

| Northeast Millair | 36 | 567.426 | $167,865,430 | $295,837 |

| Northeast Heights | 72 | 1157.015 | $258,852,810 | $223,725 |

| North Riverside | 112 | 441.23 | $312,246,810 | $707,674 |

| North Central | 129 | 276.435 | $99,061,830 | $358,355 |

| New Salem | 39 | 65.477 | $34,239,910 | $522,930 |

| Murdock | 64 | 132.463 | $51,898,610 | $391,797 |

| Meadowlark | 26 | 223.66 | $104,277,400 | $466,232 |

| Mead | 90 | 310.737 | $179,728,080 | $578,393 |

| Mccormick | 207 | 488.474 | $232,834,910 | $476,658 |

| Mcadams | 92 | 269.262 | $92,294,380 | $342,768 |

| Matlock Heights | 48 | 174.084 | $54,410,590 | $312,554 |

| Maple Hills | 9 | 190.202 | $106,535,480 | $560,118 |

| Macdonald | 22 | 318.808 | $195,793,310 | $614,142 |

| Longview | 16 | 46.09 | $30,303,820 | $657,492 |

| Linwood | 71 | 124.7 | $62,239,370 | $499,113 |

| Lambsdale | 9 | 49.668 | $34,208,990 | $688,753 |

| La Placita Park | 32 | 234.934 | $149,640,920 | $636,949 |

| Ken-Mar | 40 | 168.936 | $74,948,720 | $443,652 |

| Kellogg School | 156 | 288.63 | $225,730,860 | $782,077 |

| K-15 | 32 | 291.324 | $95,779,350 | $328,773 |

| Jones Park | 22 | 83.375 | $28,632,710 | $343,421 |

| Indian Hills Riverbend | 50 | 361.937 | $222,209,050 | $613,944 |

| Indian Hills | 36 | 501.851 | $169,291,130 | $337,333 |

| Historic Midtown | 305 | 881.556 | $793,988,220 | $900,667 |

| Hilltop - Jefferson | 58 | 213.846 | $188,347,700 | $880,763 |

| Hilltop | 10 | 118.039 | $43,639,820 | $369,707 |

| Harrison Park Rk | 7 | 239.923 | $165,321,230 | $689,060 |

| Grandview Heights | 30 | 269.269 | $120,303,050 | $446,776 |

| Fairmount | 37 | 240.454 | $102,234,490 | $425,173 |

| Fabrique | 60 | 225.131 | $136,851,260 | $607,874 |

| Eastridge | 80 | 439.586 | $278,168,020 | $632,795 |

| East Mt Vernon Na | 33 | 164.669 | $94,346,650 | $572,947 |

| East Front | 56 | 93.169 | $79,122,980 | $849,241 |

| Delano Township | 3 | 1075.363 | $34,582,470 | $32,159 |

| Delano | 340 | 693.706 | $757,175,340 | $1,091,493 |

| Crown Heights South | 23 | 116.229 | $116,287,240 | $1,000,501 |

| Crown Heights | 34 | 116.322 | $135,749,090 | $1,167,011 |

| Courtland | 18 | 96.755 | $73,787,420 | $762,621 |

| Country Overlook | 44 | 153.105 | $92,453,020 | $603,854 |

| Cottonwood Village | 12 | 214.843 | $190,305,490 | $885,789 |

| Comotara Mainsgate Villa | 6 | 214.845 | $148,152,130 | $689,577 |

| College Hill | 127 | 466.853 | $621,765,490 | $1,331,823 |

| Chisholm Creek | 139 | 1915.331 | $1,243,587,910 | $649,281 |

| Central 2000 | 56 | 104.306 | $34,903,160 | $334,623 |

| Brookhollow | 11 | 78.473 | $92,747,710 | $1,181,906 |

| Benjamin Hills | 87 | 823.901 | $414,041,240 | $502,538 |

Conclusion

We put together this Total Value Per Acre analysis as an example of how we can analyze the areas of our city and county to understand the property tax value of different areas. We are only showing a few examples of how anyone can overlay this data on a map. We encourage anyone to look at the results and understand how we can use this data to provide guidance on our housing development decisions and policy.

Credits

This data story and its content is available under the Creative Commons Attribution license.

Persons or organizations that Share or Adapt this content should provide Attribution that provides appropriate credit, which includes:

- © Copyright 2025

- Tyche Insights, P.B.C.

- WichitaDataExplorer

For example, a data product or service that utilizes this article could include attribution such as:

"Portions derived from 'Wichita, Kansas Land Value Per Acre', © Copyright 2025 by Tyche Insights, P.B.C., WichitaDataExplorer & licensed under the CC BY 4.0 license"