TycheHowTo:CreateFinanceDecoder

What is the Strong Towns Finance Decoder?

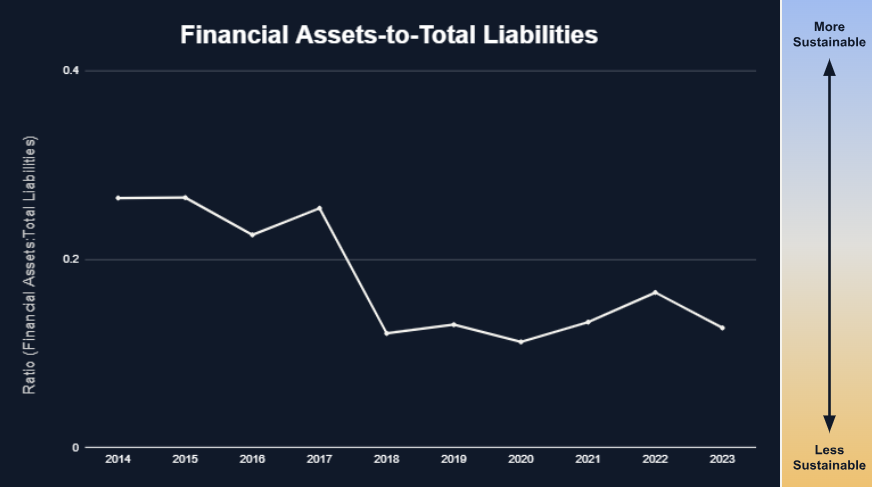

Strong Towns released the Finance Decoder in 2025 and has been explaining what it is and what the value is. The Finance Decoder is a tool to “visualize your city’s financial trajectory, and understand whether your city is on track to keep its development, service and growth promises.”

Note that a story that accompanies the Finance Decoder can be whatever you want. As we build up more examples of Finance Decoders for communities some will have larger narratives and some will have the basic graphs with narrative.

How do you create a Finance Decoder for your community?

The tool is fairly straightforward, you:

- collect your government’s yearly, publicly-available audited financial statements

- wade through the audited statements to find a dozen key numbers and input them into the Decoder tool (a Google Sheet)

- review to make sure you did the data entry correct

- publish the findings to the Strong Towns Finance Decoder map and also write a data story that includes your findings

How is the Finance Decoder used?

We like this article that explains the Finance Decoder. The article lists out three conversations that come out of a Finance Decoder:

- Can the city maintain its current level of service indefinitely?

- How much room does the city have to adjust to financial changes?

- How dependent is the city on external funding?

There are many resources available as you review and execute your plan to create the Decoder. These include:

- https://actionlab.strongtowns.org/hc/en-us/articles/40520311397268-Finance-Decoder-Tutorial-Videos-And-Instructions-PDF

- https://actionlab.strongtowns.org/hc/en-us/articles/37931141280148-ASTA-Finance-Decoder-May-28-2025

Tips and Tricks

- Make sure to use the latest version of the Finance Decoder which may fix bugs, address issues or improve the output. As of August 2025 the current version is 1.0.1

- As you review audited financial statements, look for any commentary from the auditors on "Adverse Opinions". For example, one city that we examined does not depreciate their capital assets. The auditors findings say "Matter Giving Rise to Adverse Opinion on Governmental Activities - As discussed in Note 1 to the financial statements, the City records and tracks capital assets at cost, or estimated historical cost with no allowance for depreciation. Accounting principles generally accepted in the United States of America require that capital assets be recorded at cost and depreciated over their estimated useful lives which would decrease the assets and net position while increasing expenses of the governmental activities."

- If a government controls various component units (such as a parking authority, an airport authority, the water board, etc), you will need to decide whether or not to include them in your analysis. We generally would recommend not including component units in the first version of your analysis.