TycheDataGuide:AuditedFinancialStatements

What are audited financial statements?

Audited financial statements (AFS) are unlike other sources of data or information. AFS are typically found as pdf documents that contain unstructured information in a narrative mixed with tables of information. AFS are created and released on a yearly basis, usually 6-9 months after the close of a government's fiscal year.

While the data in an AFS are unstructured, there are valuable details that can be found about a government's financial picture and health. The auditors will contextualize the financial picture with commentaries on adverse findings (e.g. a government's non-compliance with accounting rules), macroeconomic factors, long-term planning, bond ratings and more.

Where does it come from?

Audited financial statements are written by independent auditors, engaged to review a government entity's finances, typically on a yearly basis. The auditing firm will review the government's activities including revenue, expenses, net position, cash flow and other accounting dimensions. The auditors utilize principles and conventions that are enacted by the Governmental Accounting Standards Board, and will ensure that the local government is abiding by those accounting standards.

What are the primary and secondary data elements?

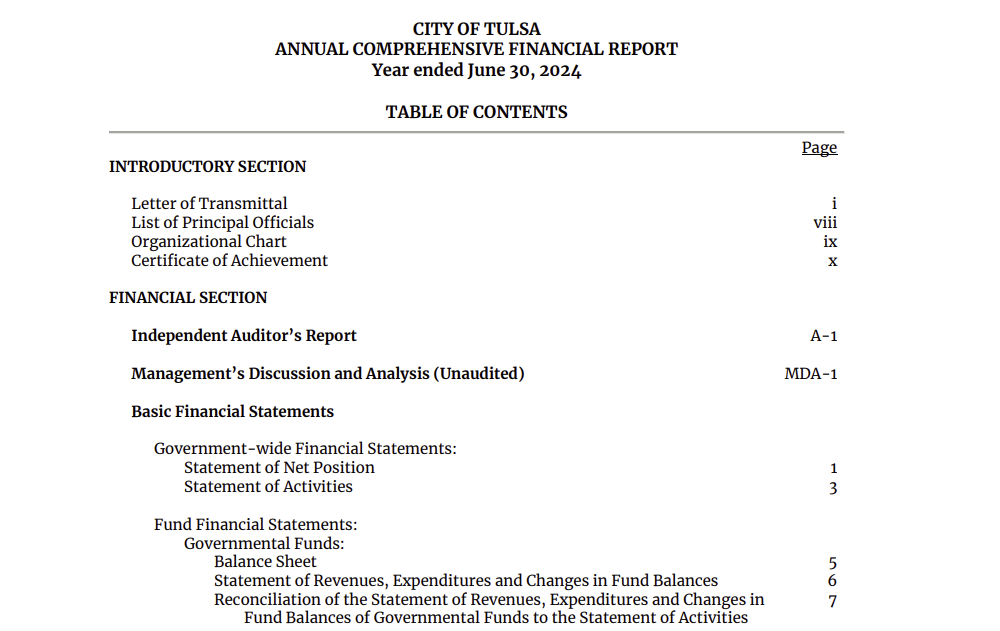

An audited financial statement is not a structured dataset, rather there is unstructured data and narrative found within the report. The first two things to look for when reviewing an audited financial statement include:

- Does the government have any "business-like" activities? Business-like activities could include utility systems, nursing homes, healthcare systems, entertainment and sporting arenas, and more. Business-like activities have their financials listed separately and alongside regular "government activities".

- Does the government have any component units? Component units are legally separate from the government however the government have some accountability for them. Component units could include community water systems, parking authorities, port authorities, and industrial development authorities.

With knowledge of whether the government has business-like activities and/or component units, you can review the various sections of an audited financial statement. These sections include:

- Overview financials - each of government activities, business-like activities and component units will list operating revenue and expenses, debt, credit ratings, and capital acquisition and construction activities

- Net Position - this section details assets, deferred outflows of resources, liabilities, deferred inflows of resources

- Balance sheet - this section contains a detailed review of assets (and deferred outflows), and liabilities (and deferred inflows)

- Revenues & expenditures - this seciton contains a detailed breakdown of the individual revenue and expenditure components

- Narratives & Notes to Financial Statements - these sections are usually associated with the various component units or government and business-like activities, and each presents a narrative containing background, stability, adverse findings.

- Capital Assets - found under "Note 7" this section reviews property and equipment, its mix of depreciation and non-depreciation, and the additions and deletions over the past year

- Special sections - there are various Notes sections that cover pensions, indebtedness, postemployment benefits, leases and more

What are questions you can answer with audited financial statements?

- Audited financial statements are the dataset that underpins the creation of a Strong Towns Finance Decoder

- What are the component units that are operated by, but separate from, the local government, and what is their performance?

- What are the government's business-like activities, and what is their performance?

- How are new revenues or new expenditures performing?

- What is/are the government's bond rating(s) and how has that changed over time?

- What is the variance between budget and actual revenues and expenditures?

- How does the government make use of revenue streams that come from state and federal sources?

- What is the government's debt, how is that debt changing, and how is the debt being maintained or paid down?

Tips and tricks for using audited financial statements

- If you are reviewing audited financial statements between 2014-2019 you may notice the impact of GASB 75. GASB is the Governmental Accounting Standards Board; the board recommended a significant change to the accounting of Postemployment Benefits during this time period which may show dramatic year-to-year changes in a government's financial picture. “Postemployment benefits” are employee benefits other than pensions that are received after employment ends, such as medical, dental, vision and prescription drug benefits.

- Deferred inflow and outflows of resources can be somewhat confusing. Outflows of resources can be seen as positive, inflows are generally negative. Looking at Outflows, they can be thought of as a positive, similar to assets, however assets provide a current service capacity to the government (e.g. cash); deferred outflows don't have a present service capacity but will reduce an expense in a future period. For example, prepaid bond insurance is a deferred outflow that will become an expense when the bond is issued.

- If you are analyzing several years of audited financial statements for a government entity, pay attention to any restatements of revenue or expenses. For example, you may find the 2022 audited financial statement lists a particular expenditure summary as $100 million; when you review the 2023 audited financial statement (which will list out the prior year's financials for context) you may see that expenditure summary is now listed as $101 or $98 million with a footnote that explains the restatement.