TycheDataGuide:AssessorData

What is Assessor Data?

Assessor data is public record information collected and maintained by local government agencies (typically at the county level) to determine the taxable value of properties within their jurisdiction.

Assessor data may also be referred to with different names. Tax assessor data, tax roll data, cadastral data and assessment data are several of the names that are used.

Assessor data is used for calculating and communicating property taxes and is updated for individual properties when ownership changes, or improvements or zoning changes. Assessor data is typically released for the entire coverage area on a yearly basis.

All property data and attributes usually supports one of a few functions:

- locating and describing location of a property - address, legal description, what boundaries does the property fall in

- cataloging the attributes that enable an assessor to fairly value the property - what is it used for, what are the physical characteristics, what buildings are on the property, when was it built, when was the property and improvements materially changed

- ownership - who or what entity owns the property, when did they acquire it, how much did they acquire it for, what address should the tax bill be sent to

Where does it come from?

Assessor data is primarily managed by the local government's Assessor's office (sometimes known as the Tax Assessor's office or similar names). The data may also be partially owned by a local government's GIS (Geographic Information Systems) office that owns the mapping for the jurisdiction.

Beyond the USA assessor data (or its equivalent) may be managed and owned by different agencies. For example, in Canada assessment data is owned by both provincial and municipal agencies.

How do you acquire Assessor Data?

Assessor data is typically managed at the County level for most states with the exception of many New England states where the data are managed at the Town level.

- We recommend starting with the County, begin searching for "<county state> assessor data downloads" or similar searches.

- If you are focused on studying just a city, you may find that the city has their own copy of assessor data where they have carved out assessor data for just their city.

- Some states have clearinghouses where the individual county or town assessment rolls are aggregated. For example, Massachusetts aggregates its data here.

- You may find that the data are linked or joined to parcel geographic (GIS) data. If you are unfamiliar with GIS technology the site where you find the assessor data may allow you some download options, in which case download the data in .csv format so that you can import into Microsoft Excel or Google Sheets.

- If you are acquiring assessor data through an open data site, through a FOIL or through a less formal request process, we recommend attempting to acquire multiple years of data. This will allow you to perform studies that look at property (and related changes) over time.

What are the primary and secondary data elements?

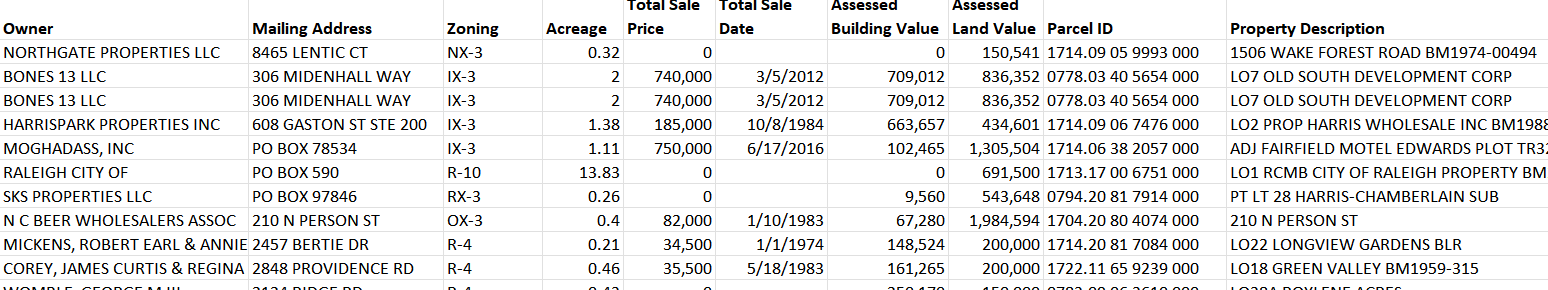

The data elements that are found in assessor data

- unique identifiers - typically the APN (Assessor Parcel Number)

- ownership - what business or residential entity(ies) owns the property

- ownership type - is the owner a person, LLC, Inc, government

- addresses - what is the property address and ownership address

- value - these can include property value, improved value, recent sales figure or assessed value

- physical characteristics - property acreage, number of bedrooms and stories, building square footage

- usage - commercial or residential, 2 family apt, farm, govt building, etc

- time information - year built, year sold

- community information - what census block group, incorporated entity, neighborhood, development etc is the property in

We recommend always retrieving or asking for assessor data documentation. In addition to basic information about the data schema you also want to have documentation on any coding systems that are used in any of the fields, for example zoning codes, land use codes, taxable status codes and more. These codes may be local to the county or city, or they may be state or provincial coding systems.

What are questions that you can answer with Assessor Data

Assessor data is a swiss army knife of information that can answer many questions associated with the physical characteristics, ownership and value of property. Some questions that you may want to answer with assessor data include:

- what is the ownership of land by type of owner (business, govt, individuals, absentee)?

- what is the ownership of land by specific owner (and related entities)?

- what is the development of the community over time?

- how have the tax assessment values changed over time?

- how have sale prices changed over time?

- how is property distributed among common residential, commercial, government and other uses?

- how much property is owner-occupied?

- what types of entities are acquiring property?

All questions above can be aggregated to subgeographies such as neighborhoods, census tracts, local incorporated or unincorporated entities and more

Tips and tricks for using Assessor Data

- When importing assessor data there are typically fields that should be read in as character fields that may be interpreted as numerics. For example, a parcel identifier may be "00000063781100"; you do not want this read in as a numeric field and turned into the value 63,781,100.

- Assessment data will typically have an owners address and a property address. These may be the same if the property is owner-occupied, or different if a rental property.

- Assessor data will usually have three values for the property - a land value, an improved value, and a total value. The improved value is the value of anything constructed on the property, which could include houses, commercial space, or other infrastructure.