SaratogaSprings, New York Financial State

The City of Saratoga Springs and the Strong Towns Finance Decoder

We wanted to find a way to view the health of the City of Saratoga Spring's finances over time using the Strong Towns Finance Decoder.

Strong Towns has a vision - “Your community needs you to be an effective advocate for change. We can help you get there” which is something that we relate to.

Strong Towns recently released the Finance Decoder, a tool to “visualize your city’s financial trajectory, and understand whether your city is on track to keep its development, service and growth promises.”

The tool is fairly straightforward: 1) you collect your city’s yearly, publicly available audited statements, 2) wade through the audited statements to find a dozen key numbers and input them into the Decoder tool (a Google Sheet), 3) review to make sure you did the data entry correct. What do Audited Statements look like? This is an example from the City of Saratoga Springs' Audited Financial Statement for 2023.

We like the Strong Towns’ Finance Decoder for a number of reasons. You don’t need to be a CPA to input the data, you only need some patience to find key numbers such as the City’s total liabilities, or yearly interest payments. The tool presents the City’s data using 7 basic charts which are relatively easy for a layperson (like us!) to visualize and understand. The story presented is high level and does not get into the weeds; having read through a number of the Audited Statements it is easy to get overwhelmed with accounting details.

In the remainder of this article we will speak to our high-level process, we will describe one of the biggest caveats when looking at the data, we will show the 7 charts with their descriptions, and, lastly, we will provide a more detailed account of our process for those who want to know and/or validate what we did.

The Google Sheet that shows the full Finance Decoder for Saratoga can be found online here.

Note at the end of the article we add in a link to the New York State Comptroller's Fiscal Stress Monitoring scoring for an additional data point about the City's health.

GASB 75 and Increasing Liabilities in 2018

An important note when looking at the City's finances - the biggest surprise when inputting audited financial information was what happened in 2018’s financial statements and related data. The Liabilities line jumped from $152 million in liabilities to $215 million between 2017 and 2018. What happened?

In 2018 the City had to recognize a new accounting standard, GASB 75. GASB is the Governmental Accounting Standards Board; the board recommended a significant change to the accounting of Postemployment Benefits. “Postemployment benefits” are employee benefits other than pensions that are received after employment ends, such as medical, dental, vision and prescription drug benefits. This was a pervasive accounting change that impacted many cities, not just Saratoga Springs, and yielded lots of questions.

The net impact of GASB 75 is that any chart that uses Liabilities in the formula will show a significant change between 2017 and 2018 with the 2018 showing a more negative presentation. Our point of view is that 2018’s data shows an increased liability that was there all along and that did not surface until the GASB accounting change. This is not an indictment of the City of Saratoga Springs, this is a reflection that the way of doing things changed for all government entities.

7 Charts that explain Saratoga Springs

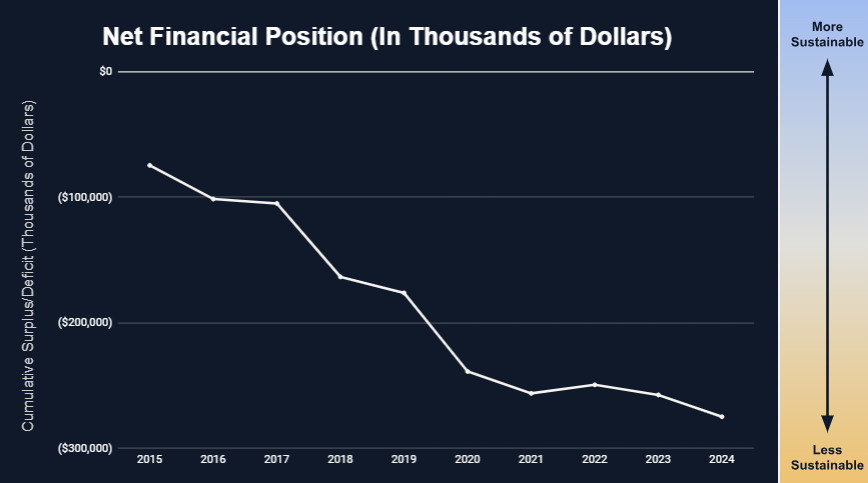

Sustainability Indicator - Net Financial Position

What it is:

The difference between the city’s financial assets (like cash and receivables) and its liabilities (like debt and pensions). This is the cumulative surplus/deficit that the city has accumulated through successive budget cycles.

What it tells you:

A positive net financial position suggests the city has more financial assets than obligations and is in a better position to weather downturns, invest in infrastructure, or respond to emergencies without resorting to borrowing or service cuts. If this number is negative, the city has spent more than it has saved and is relying on future revenue to pay past bills.

What the trend shows:

A downward trend means the city is growing more reliant on borrowing or deferring payments. An upward trend means it’s becoming more financially secure.

Our view:

Liabilities increased dramatically in 2018 due to GASB 75. In addition, there continues to be a trend showing an accumulation of liabiltiies.

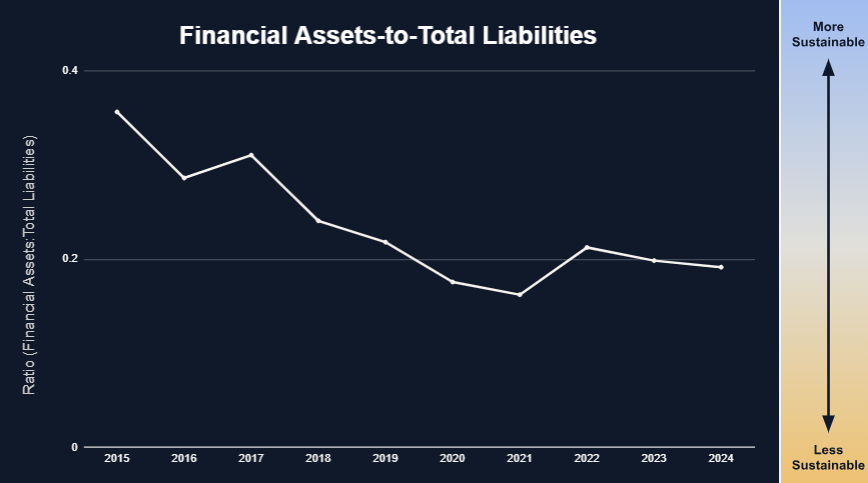

Sustainability Indicator - Financial Assets to Liabilities

What it is:

The city’s financial assets—such as cash, receivables, and other short-term holdings—divided by its total liabilities. This is a different way of presenting the Net Financial Position.

What it tells you:

This ratio shows whether the city has enough liquid financial resources to cover what it owes. A ratio below 1 means it would not be able to pay off its liabilities using only its financial assets, which is a sign of financial stress.

What the trend shows:

A rising trend means the city is improving its financial buffer. A falling trend suggests the city is becoming less able to handle its obligations without borrowing or cutting services.

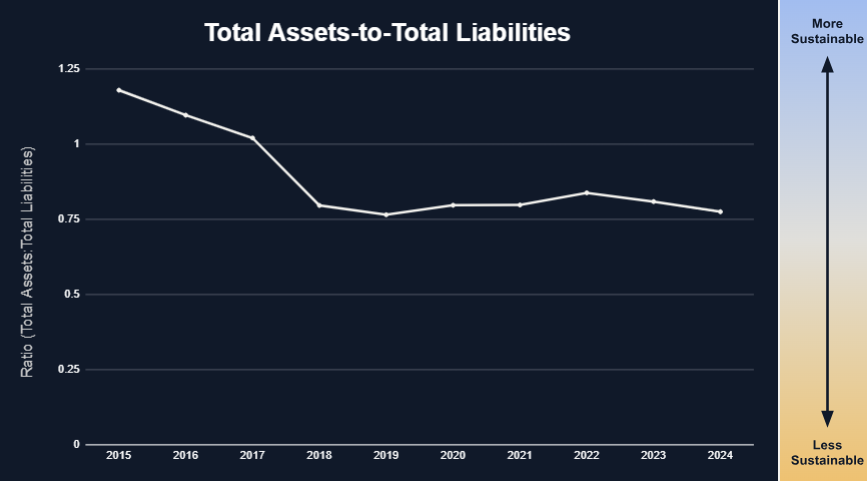

Sustainability Indicator - Total Assets to Total Liabilities

What it is:

The value of all the city’s assets (including infrastructure) divided by its total liabilities.

What it tells you:

A ratio above 1 means the city owns more than it owes (solvent). Below 1 means it owes more than it owns (insolvent).

What the trend shows:

A downward trend means the city is becoming less solvent. An upward trend shows improving financial resilience.

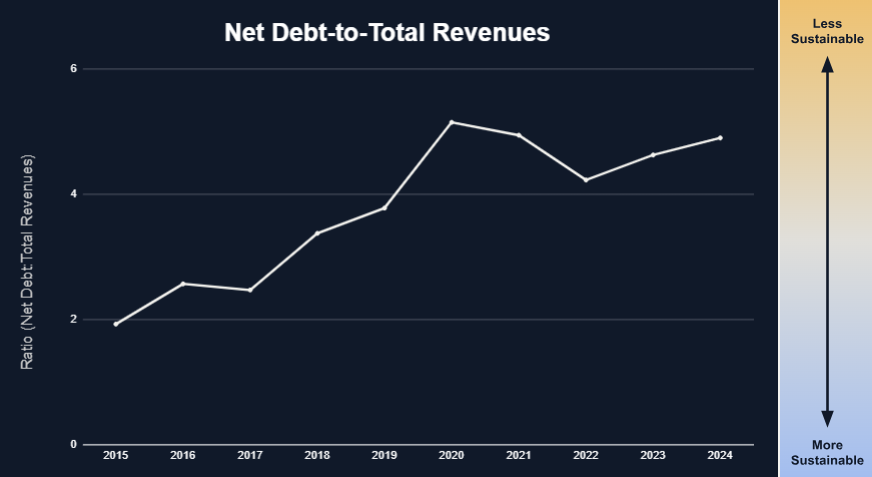

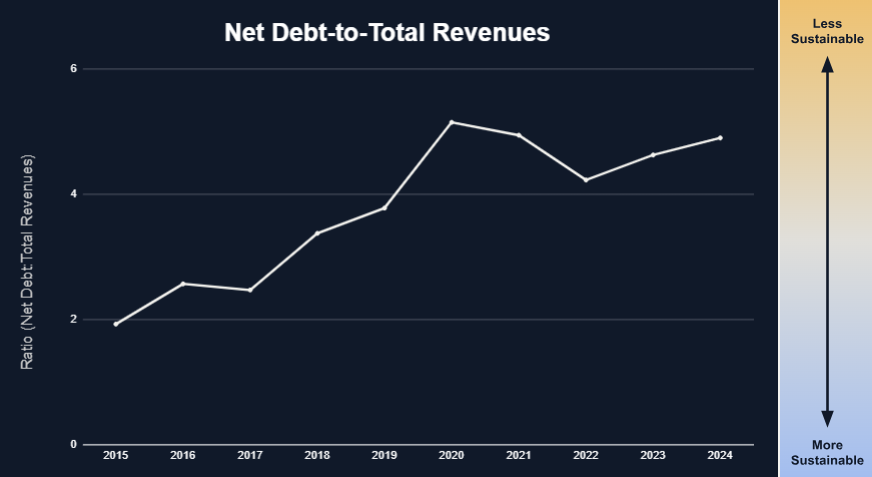

Sustainability Indicator - Debt to Total Revenues

What it is:

The total liabilities the city owes compared to how much revenue it collects in a year.

What it tells you:

This shows how many years of income it would take to pay off all debts if every dollar went to debt repayment.

What the trend shows:

If the ratio is rising, debt is growing faster than income—this is unsustainable. If it’s falling, the city is gaining control of its obligations.

Our view:

While our liabilities have grown over 40% from 2018 to 2019, our revenue has grown around 17%. This causes our debt to revenue ratio to grow in a dramatic fashion.

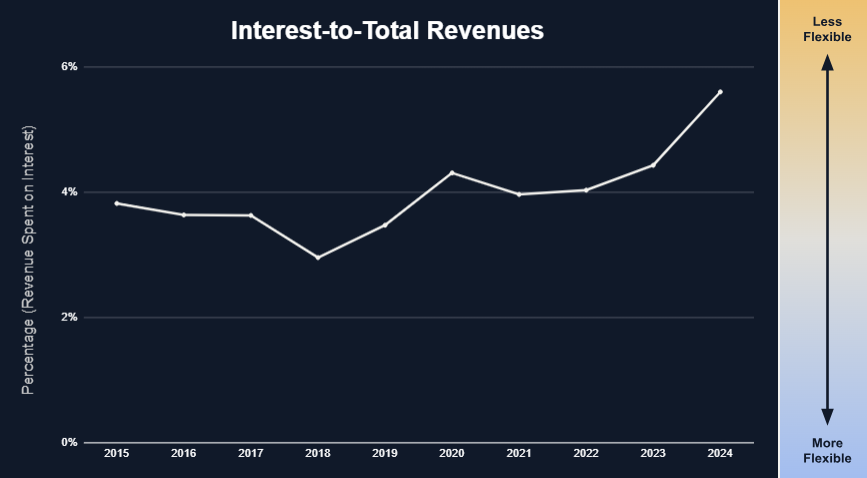

Flexibility Indicator - Interest to Revenues

What it is:

The percentage of annual revenue spent on interest payments.

What it tells you:

This shows how much of the budget is consumed by past borrowing. The higher the percentage, the less room for services, maintenance, or investment.

What the trend shows:

An increasing trend limits future choices and can crowd out basic services. A decreasing trend improves flexibility and budget health.

Our view:

The interest that we are paying on our debt, as a percentage of overall revenue, has been stable until an uptick in 2023 and 2024. We have more borrowing and debt, and the portion of our revenues allocated to interest is increasing in a concerning fashion.

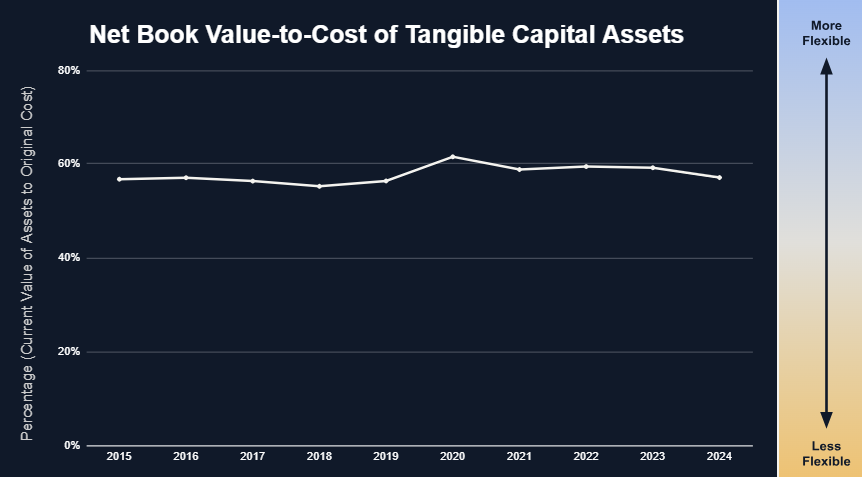

Flexibility Indicator - Value to cost of tangible assets

What it is:

The current value of the city’s physical assets compared to their original cost.

What it tells you:

This indicates how well the city is maintaining its infrastructure. A low value means assets are aging and wearing out.

What the trend shows:

A declining trend means the city is falling behind on maintenance. A stable or rising trend suggests it is keeping up

Our view:

Our management of our assets is stable, however higher performing cities typically have ratios around 0.65-0.75.

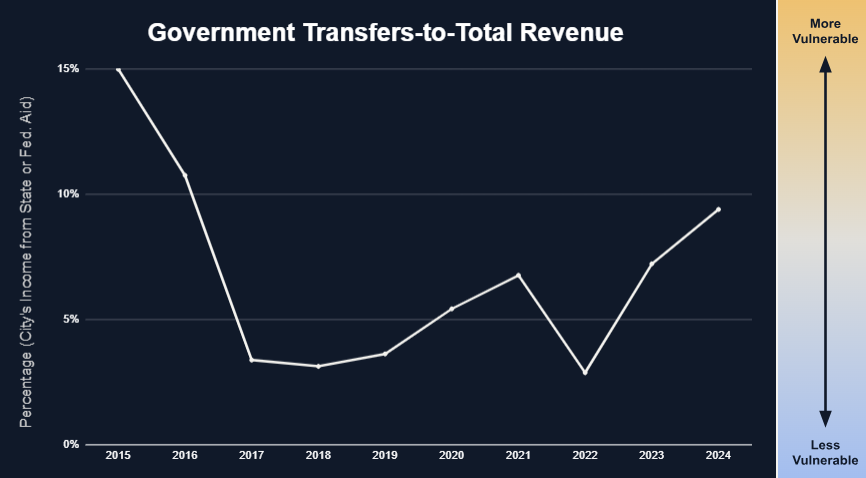

Results - Govt Transfers to Total revenue

What it is:

The share of the city’s income that comes from state or federal aid.

What it tells you:

High dependency on outside funding makes the city vulnerable to political or economic shifts beyond its control.

What the trend shows:

If the trend is rising, the city is becoming more dependent on outside help. If it’s falling, the city is strengthening its local revenue base.

Our view:

Our outside aid has grown from $1.6 million in 2019 and 2022 (ignoring 2020 and 2021 which had COVID pandemic-related adjustments) to $5.2 million in 2024. The City should pay attention to the stability or risk associated with this growth.

New York State Comptroller's Fiscal Stress Monitoring

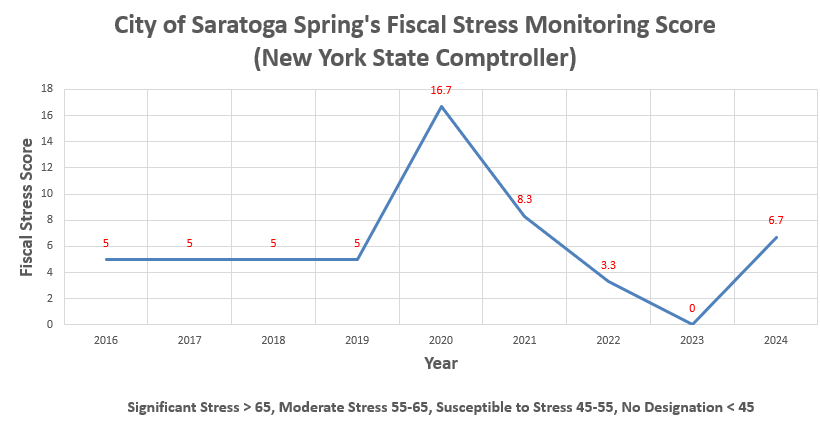

The Finance Decoder presents one view into our financial health. The New York State Comptroller evaluates government finances on a yearly basis using their Fiscal Stress Monitoring System. The Comptroller's monitoring system looks at other variables that have some overlap with the Finance Decoder, so it represents a good check.

The chart above presents the Fiscal Stress Monitoring System results for the City of Saratoga Springs, between 2016 and 2024 (the 2024 results were published in September). Note that the Comptroller did not evaluate the City in 2023.

The Fiscal Stress Monitoring System scores each government's finances between 0 (great) and 100 (bad) using 9 graded indicators. There are bands or ranges that designate performance:

- 0-45 - No designation (this is the best rating)

- 45-55 - Susceptible to stress

- 55-65 - Moderate stress

- 65+ - Significant stress

Saratoga Springs does not show up as having any heightened level of stress using the Comptroller's fiscal stress system. 2024 does represent an uptick in the score so this should be watched year over year to see if the trend continues.

Data

For this study we used the City of Saratoga Spring's Audited Financial statements from 2015 through 2024. This gives us 10 years of Audited data to input into the template. We collected the Audited Financial statements from the City’s website.

While we have made every attempt to ensure that we have done the data entry correctly, and we believe that we have input correct information into the Finance Decoder it is possible that we have made one or more mistakes. We appreciate readers noting any issues that they see.

Note that we are making a copy of the completed Finance Decoder available here. This document is a Google Sheet and you will have read-only access to the Finance Decoder. We recommend saving a copy (File > Make a Copy) if you want to analyze, change, recreate, etc.

Process

In this section we will provide details on how and where we drew information from the Audited Financial Statements. There are 12 data points that we gathered. We will use the 2021 Statement as an example of where, specifically, we found the data.

Note that the City changed the auditing treatment of various components over time. The City manages general government operations plus three other entities: sewer, water and the City Center. Between 2019 and 2020 the auditing treatment of these three units changed. Prior to 2020 these units were treated as business-type activities. From 2020 to present, sewer and water are a part of governmental activities and the City Center is a component unit that has its own financials.

Credits

This data story and its content is available under the Creative Commons Attribution license.

Persons or organizations that Share or Adapt this content should provide Attribution that provides appropriate credit, which includes:

- © Copyright 2025

- Tyche Insights, P.B.C.

- TogaDave

For example, a data product or service that utilizes this article could include attribution such as:

"Portions derived from 'Saratoga Springs NY Financial State', © Copyright 2025 by Tyche Insights, P.B.C., TogaDave & licensed under the CC BY 4.0 license"