Danbury, Connecticut Financial State

The City of Danbury, Connecticut and the Strong Towns Finance Decoder

We wanted to find a way to view the health of Danbury, Connecticut's finances over time using the Strong Towns Finance Decoder.

Strong Towns has a vision - “Your community needs you to be an effective advocate for change. We can help you get there” which is something that we relate to. Strong Towns recently released the Finance Decoder, a tool to “visualize your city’s financial trajectory, and understand whether your city is on track to keep its development, service and growth promises.”

The tool is fairly straightforward: 1) you collect your city’s yearly, publicly available audited statements, 2) wade through the audited statements to find a dozen key numbers and input them into the Decoder tool (a Google Sheet), 3) review to make sure you did the data entry correct. What do Audited Statements look like? This is an example of Danbury's Audited Financial Statement for 2023.

We like the Strong Towns’ Finance Decoder for a number of reasons. You don’t need to be a CPA to input the data, you only need some patience to find key numbers such as the City’s total liabilities, or yearly interest payments. The tool presents the City’s data using 7 basic charts which are relatively easy for a layperson to visualize and understand. The story presented is high level and does not get into the weeds; having read through a number of the Audited Statements it is easy to get overwhelmed with accounting details.

In the remainder of this article we will speak to our high-level process, we will show the 7 charts with their descriptions, and, lastly, we will provide a more detailed account of our process for those who want to know and/or validate what we did.

The Google Sheet that shows the full Finance Decoder for Danbury can be found online here.

Danbury's Government Activities versus Business-type Activities

For this Finance Decoder analysis we are analyzing a combination of Danbury's government activities and business-type activities. Danbury's business type activities include the following systems: water, sewer, and ambulance funds.

This analysis does not include the City's separate component units which includes the Parking Authority, Richter Park Authority, Tarrywile Park Authority and the Danbury Museum.

7 Charts that explain Danbury, Connecticut

Note that these charts can be found under the "Results" tab of the Finance Decoder google sheet.

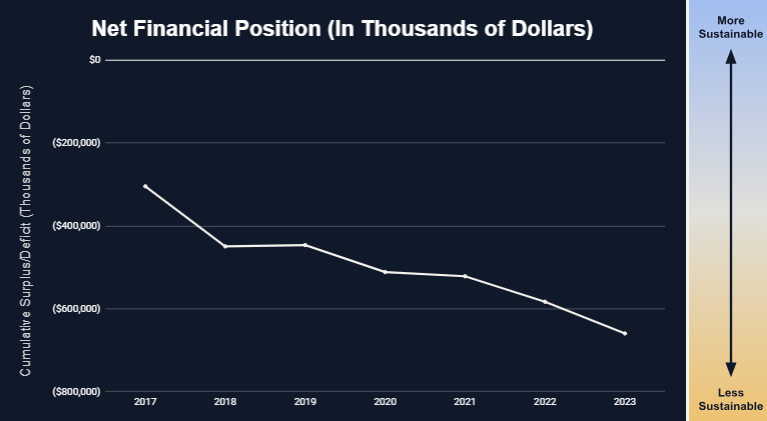

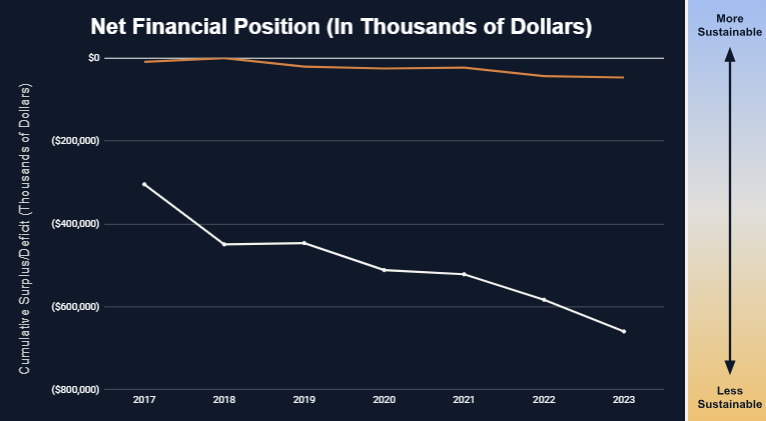

Sustainability Indicator - Net Financial Position

What it is:

The difference between the city’s financial assets (like cash and receivables) and its liabilities (like debt and pensions). This is the cumulative surplus/deficit that the city has accumulated through successive budget cycles.

What it tells you:

A positive net financial position suggests the city has more financial assets than obligations and is in a better position to weather downturns, invest in infrastructure, or respond to emergencies without resorting to borrowing or service cuts. If this number is negative, the city has spent more than it has saved and is relying on future revenue to pay past bills.

What the trend shows:

A downward trend means the city is growing more reliant on borrowing or deferring payments. An upward trend means it’s becoming more financially secure.

Our view:

Danbury's Net Financial Position has degraded over the 7 year study. We want to review the 2024 audited financial statement when it is available.

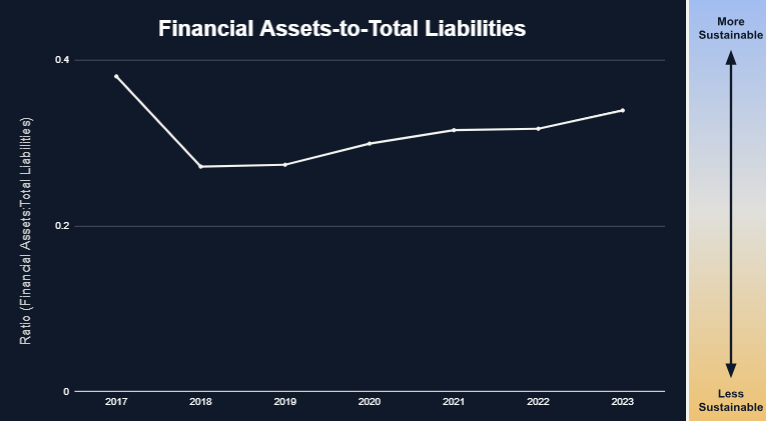

Sustainability Indicator - Financial Assets to Liabilities

What it is:

The city’s financial assets—such as cash, receivables, and other short-term holdings—divided by its total liabilities. This is a different way of presenting the Net Financial Position.

What it tells you:

This ratio shows whether the city has enough liquid financial resources to cover what it owes. A ratio below 1 means it would not be able to pay off its liabilities using only its financial assets, which is a sign of financial stress.

What the trend shows:

A rising trend means the city is improving its financial buffer. A falling trend suggests the city is becoming less able to handle its obligations without borrowing or cutting services.

Our view:

The trendline for this metric is positive, driven by management of liabilities.

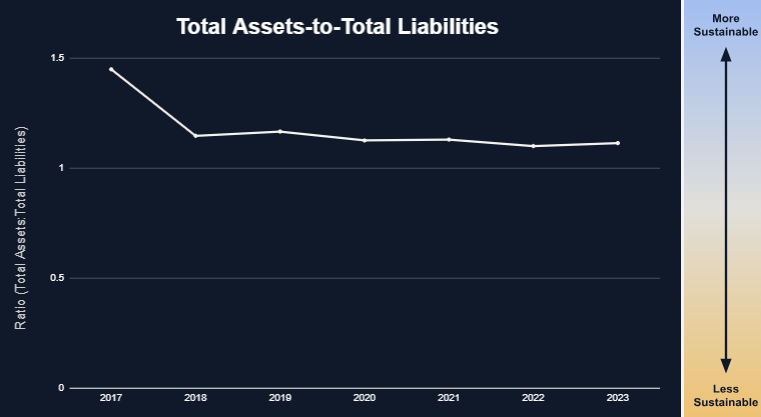

Sustainability Indicator - Total Assets to Total Liabilities

What it is:

The value of all the city’s assets (including infrastructure) divided by its total liabilities.

What it tells you:

A ratio above 1 means the city owns more than it owes (solvent). Below 1 means it owes more than it owns (insolvent).

What the trend shows:

A downward trend means the city is becoming less solvent. An upward trend shows improving financial resilience.

Our view:

The total assets to total liabilities metric is flat over the study period.

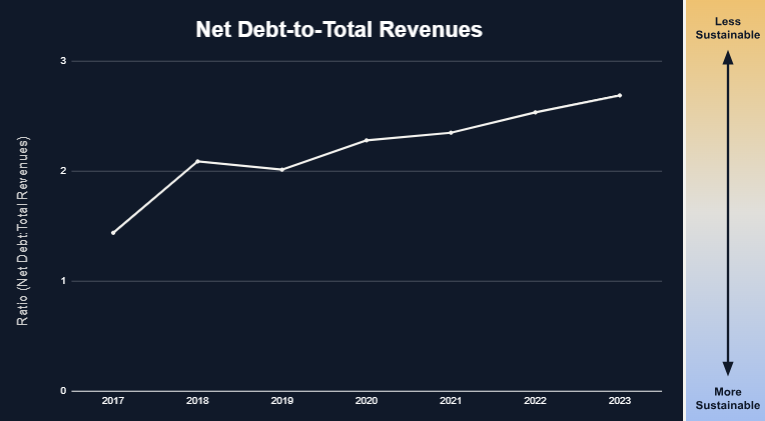

Sustainability Indicator - Debt to Total Revenues

What it is:

The total liabilities the city owes compared to how much revenue it collects in a year.

What it tells you:

This shows how many years of income it would take to pay off all debts if every dollar went to debt repayment.

What the trend shows:

If the ratio is rising, debt is growing faster than income—this is unsustainable. If it’s falling, the city is gaining control of its obligations.

Our view:

The City's debt to total revenue ratio is concerning, growing in a path similar to the Net Financial Position metric.

Flexibility Indicator - Interest to Revenues

What it is:

The percentage of annual revenue spent on interest payments.

What it tells you:

This shows how much of the budget is consumed by past borrowing. The higher the percentage, the less room for services, maintenance, or investment.

What the trend shows:

An increasing trend limits future choices and can crowd out basic services. A decreasing trend improves flexibility and budget health.

Our view:

Note that 2023 has no/low interest payments presented in the audited financial statement. This appears to be due to the seasonality of the payments. Otherwise the Interest to total revenue ratio is not concerning.

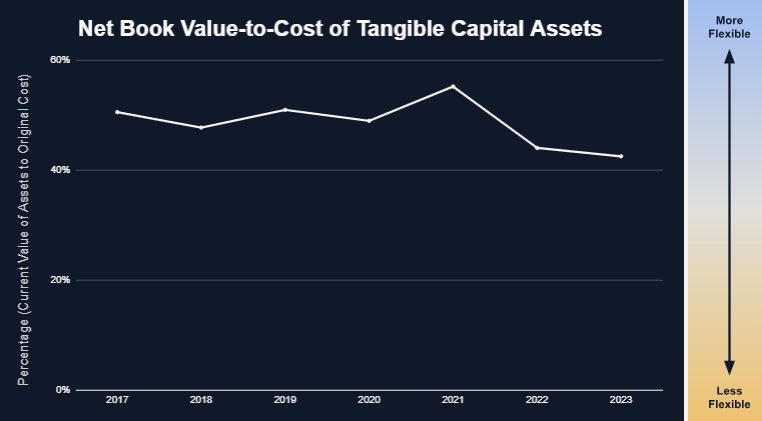

Flexibility Indicator - Value to cost of tangible assets

What it is:

The current value of the city’s physical assets compared to their original cost.

What it tells you:

This indicates how well the city is maintaining its infrastructure. A low value means assets are aging and wearing out.

What the trend shows:

A declining trend means the city is falling behind on maintenance. A stable or rising trend suggests it is keeping up

Our view:

High performing cities that are managing and maintaining their infrastructure at the highest levels will have ratios around and above 65-70%. Danbury's ratio is significantly underperforming.

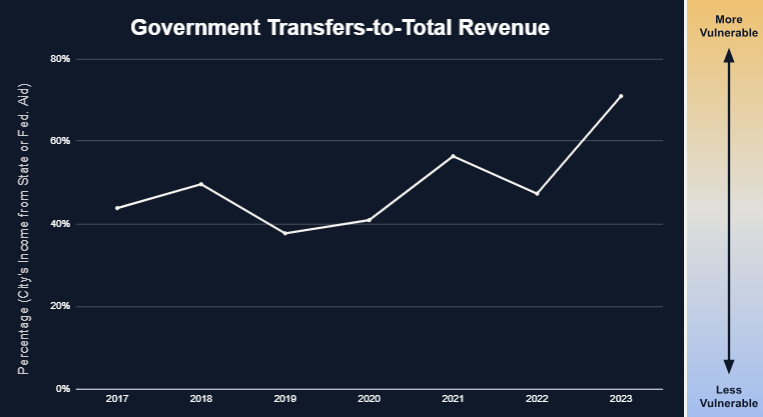

Results - Government Transfers to Total Revenue

What it is:

The share of the city’s income that comes from state or federal aid.

What it tells you:

High dependency on outside funding makes the city vulnerable to political or economic shifts beyond its control.

What the trend shows:

If the trend is rising, the city is becoming more dependent on outside help. If it’s falling, the city is strengthening its local revenue base.

Our view:

Government transfers, education and non-education, state and federal, are growing to a concerning level as a percentage of overall City revenue.

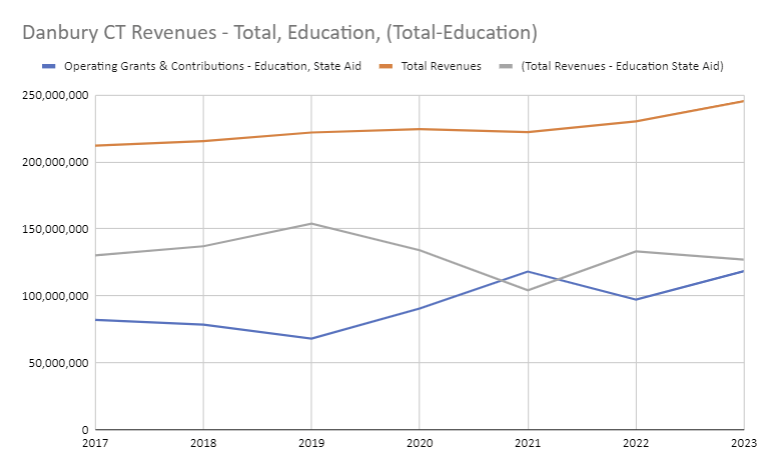

Danbury Education Revenue versus Total Revenue

In Connecticut most if not all towns have their education revenue and expenses included in the overall budget. For Danbury we wanted to present a basic understanding of how much of the City's budget (revenue) is comprised of education revenue. This is a preliminary view that we want to expand on in the future. Within the Finance Decoder Google Sheet look for the tab "Total Revenue & State Education Aid Revenue" to see the table and graph below.

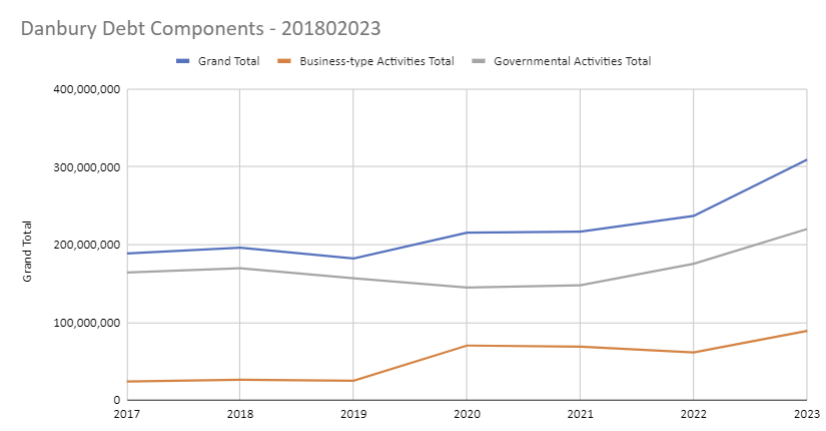

Danbury Debt

Looking through the audited financial statements we noticed that the City's debt had grown from $188 million in 2017 to over $309 million in 2023. We wanted to see how this debt accumulated so we created a separate tab in the Finance Decoder called "Debt" where we laid out the Governmental activity debt and business-type activity debt from 2017 to 2023. We will analyze this further to understand the details, specifically what is driving the large growth in debt between 2022 and 2023.

Danbury vs New Milford

Strong Towns came up with a process to compare the results of multiple Finance Decoders. We created a Finance Decoder for New Milford, CT, a town north of Danbury, and we used the process to compare the two local governments. While Danbury is 3x the population of New Milford we can still get meaning from the metrics that are ratios and we can compare the trajectories of the dollar valued metrics. For the full comparison look at this Finance Decoder here under the "Results" tab.

We have two illustrative charts here to show comparisons -

Data

For this study we used the Danbury's Audited Financial statements from 2017 through 2023. This gives us 7 years of Audited data to input into the template. We collected the Audited Financial statements from the City’s website.

While we have made every attempt to ensure that we have done the data entry correctly, and we believe that we have input correct information into the Finance Decoder it is possible that we have made one or more mistakes. We appreciate readers noting any issues that they see.

Note that we are making a copy of the completed Finance Decoder available here. This document is a Google Sheet and you will have read-only access to the Finance Decoder. We recommend saving a copy (File > Make a Copy) if you want to analyze, change, recreate, etc.

Credits

This data story and its content is available under the Creative Commons Attribution license.

Persons or organizations that Share or Adapt this content should provide Attribution that provides appropriate credit, which includes:

© Copyright 2026

Tyche Insights, P.B.C.

For example, a data product or service that utilizes this article could include attribution such as:

"Portions derived from 'Danbury, CT Financial State', © Copyright 2026 by Tyche Insights, P.B.C., WestCOGExpat & licensed under the CC BY 4.0 license"