Albany, New York Budget

Article published February, 2025.

Albany’s Budget - 2017-2025. 4 Observations about the budgets over the years

Overview

One of our more ambitious efforts is to review the City of Albany’s budget data. We had a few initial questions:

- What is the size of the budget?

- What are the revenue and expense components of the budget?

- What are the budgetary trends?

- Is there anything that is not understandable or that we need additional context to understand?

Albany’s Budget Office manages the budgets and makes current and past budgets available via their portal. We made a decision to look at the approved budgets (2017-2024) and the 2025 proposed budget, 9 years of budgets. We will make the Excel spreadsheet with all of the data available for anyone to follow along or perform their own analysis.

Before reviewing our analysis and thoughts, we would suggest doing a quick review of one of the budget presentations; 2024 works well. The Mayor and Budget Office have created a readable and understandable narrative on top of the basic facts of the budget.

An Albany budget has 3 main sections - a Revenue overview, a Revenue breakdown and an Expenditures breakdown. There are two separate sections that we did not include in our analysis - the Youth & Workforce Services Fund and the Water Fund which are out of scope for this analysis.

The Revenue Overview breaks down the two main revenue sources -

- General Fund - $158.3 million in the 2025 proposed budget

- Realty Taxes - $63 million in the 2025 proposed budget

In this article we will show the Revenue and Expense breakdowns, explain several additions that we make to the budget sheet to help us with our analysis and drill into 14 questions and observations from the 2017-2015 budgets.

The City of Albany's Revenue and Expenditures

Revenue Breakdown

| Revenue Item | 2025 Budget | 2024 Budget |

|---|---|---|

| State Aid | $ 19,242,862 | $ 17,480,268 |

| Capital City Funding | $ 20,000,000 | $ 15,000,000 |

| 19A Pilot | $ 15,000,000 | $ 15,000,000 |

| Sales & Use Tax | $ 49,948,000 | $ 48,629,000 |

| Property Tax | $ 62,731,000 | $ 61,497,000 |

| Other PILOTS & Taxes | $ 7,194,000 | $ 6,322,000 |

| Landfill Income | $ 4,105,000 | $ 3,230,000 |

| Departmental Income | $ 25,188,500 | $ 17,867,700 |

| Inter-Fund Transfers | $ 2,920,127 | $ 2,184,000 |

| All Other (includes Federal Aid for 2024 & 2025) | $ 14,927,476 | $ 38,800,943 |

What is in each Revenue category?

- State Aid - includes NY State Aid to Municipalities (AIM), Mortgage tax, public safety and some smaller revenue sources

- Capital City Funding - additional state aid that makes up for an imbalance in our AIM funding

- 19A Pilot - Payment in Lieu of Taxes (PILOT) from NY State for the Empire State Plaza

- Federal Aid - American Rescue Plan and various Federal grants

- Sales & Use Tax - any taxes levied on different transactions

- Property Tax - commercial and residential property taxes

- Other PILOTS & Taxes - voluntary payments from Wholly Exempt property owners

- Landfill Income - landfill usage charges, sale of methane gas produced from the landfill

- Departmental Income - fees and income from waste collection, Department of General Services, code violations, golf course income, and various other revenue generating programs

- Inter-Fund Transfers - per the budget office “An internal transaction that moves money from one major fund to another in furtherance of maintaining a balanced budget and recognizing spending appropriately”

- Appropriated Debt Reserve - this is a revenue line that only appears in the 2020-22 budgets; we need more understanding of what this is

- All Other - includes Federal Aid for 2024 & 2025, NY Opioid settlement funds

Expenditures Breakdown

| Expenditure Item | 2025 Budget | 2024 Budget |

|---|---|---|

| Wages | $ 100,026,611 | $ 96,808,273 |

| Retirement | $ 20,863,181 | $ 19,882,000 |

| FICA | $ 7,382,511 | $ 6,953,029 |

| Health Insurance & Other Employee Benefits | $ 17,681,346 | $ 17,338,756 |

| Retiree Health Insurance & Medicare | $ 12,070,370 | $ 14,039,610 |

| Workers Compensation | $ 3,577,000 | $ 3,592,000 |

| Operating Expenses | $ 38,734,400 | $ 38,087,119 |

| Albany for All | $ 2,000,000 | $ 12,000,000 |

| Debt Service | $ 16,986,546 | $ 15,540,124 |

| Interfund Transfers | $ 1,935,000 | $ 1,770,000 |

What is in each Expenditures category?

- Wages - salaries

- Retirement - payments to the NY State Retirement system and Social Security

- FICA - payroll tax (Federal Insurance Contributions Act)

- Health Insurance & Other Employee Benefits - self-described

- Retiree Health Insurance & Medicare - self-described

- Workers Compensation - self-described

- Operating Expenses - expenditures from ongoing city programming, maintenance, and public works project

- Albany for All - distribution of American Rescue Plan Act (ARPA) funding through grants focused on housing, community spaces and direct services

- Debt Service - Required payments of principal and interest on bonds and notes issued.

- Interfund Transfers - per the budget office “An internal transaction that moves money from one major fund to another in furtherance of maintaining a balanced budget and recognizing spending appropriately”

Changes in Revenue and Expenditures Over Time

How have Albany's Revenue and Expenditures changed over time? We can look at several views into multiyear change and change over the prior year.

Expenditure Growth - 2017 to 2025

How have expenditures changed over 9 years of budgets? We looked at the overall growth between 2017 to 2015 on a percentage basis. Expenditures grow unevenly by budget category. Retirement and Operating Expenses have the greatest growth rate; Debt Service and Workers Compensation costs have the fastest rate of decline.

| Expenditures | 2025 Budget | 2017 Budget | 2017-2025 Growth |

|---|---|---|---|

| Wages | $ 100,026,611 | $ 75,537,241 | 32% |

| Retirement | $ 20,863,181 | $ 14,389,619 | 45% |

| FICA | $ 7,382,511 | $ 5,929,238 | 25% |

| Health Insurance &

Other Employee Benefits |

$ 17,681,346 | $ 16,061,131 | 10% |

| Retiree Health Insurance &

Medicare |

$ 12,070,370 | $ 11,715,151 | 3% |

| Workers Compensation | $ 3,577,000 | $ 3,985,637 | -10% |

| Operating Expenses | $ 38,734,400 | $ 27,518,519 | 41% |

| Albany for All | $ 2,000,000 | $ - | 0% |

| Debt Service | $ 16,986,546 | $ 21,846,267 | -22% |

| Interfund Transfers | $ 1,935,000 | $ - | 0% |

Revenue detail growth - Year over year

We created a separate table that, for each revenue component, shows the growth between the previous year and current year.

For example, State Aid declined 3% between 2021 ($16.458 million) and 2022 ($15.883 million). We also color coded the table so that revenue increases are dark and light green (a generally favorable event); and revenue loss is colored in red and yellow. Note the decline in “All Other” in 2025 as the Federal American Rescue Plan Act funding declines dramatically.

| Revenue Item | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|---|

| State Aid | 10% | 3% | 6% | -3% | -1% | 1% | 0% | 0% |

| Capital City Funding | 33% | 0% | 0% | 20% | 0% | 0% | 0% | 0% |

| 19A Pilot | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Sales & Use Tax | 3% | 4% | 22% | 8% | -3% | 6% | 3% | -2% |

| Property Tax | 2% | 2% | 2% | 0% | 2% | 1% | 0% | 1% |

| Other PILOTS & Taxes | 14% | -5% | 18% | -13% | 3% | 35% | -37% | 6% |

| Landfill Income | 27% | -11% | 15% | -49% | -1% | 2% | -1% | -17% |

| Departmental Income | 41% | -1% | 7% | 0% | 5% | 4% | 2% | 4% |

| All Other (includes Federal Aid for 2024 & 2025) | -62% | 20% | 57% | 64% | 8% | -17% | 18% | -3% |

Expenditure Detail Growth

We created a separate table that, for each expenditure component, shows the growth or decline between the previous year and current year. We color coded this table where expenditure decline (generally a positive thing) shows up in dark and light green; expenditure growth shows up in red and yellow. For example, in 2025 FICA costs increased by 6% over 2024.

| Expenditure Item | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|---|

| Wages | 3% | 6% | 10% | 4% | 2% | 1% | 4% | -2% |

| Retirement | 5% | 10% | 13% | 1% | 7% | 10% | -8% | 1% |

| FICA | 6% | 4% | 1% | 6% | 3% | 5% | 4% | -7% |

| Health Insurance & Other Employee Benefits | 2% | 5% | -4% | 0% | 3% | 1% | 1% | 0% |

| Retiree Health Insurance & Medicare | -14% | 9% | 23% | 0% | -1% | 3% | -8% | -6% |

| Workers Compensation | 0% | 4% | -25% | 4% | 0% | 1% | 2% | 8% |

| Operating Expenses | 2% | 3% | 8% | 23% | 2% | -11% | 6% | 5% |

| Debt Service | 9% | -23% | 18% | -4% | -24% | 24% | -12% | -1% |

Revenue Yearly growth rate - median and standard deviation

Lastly, we added for every Revenue and Expenditure component two additional calculations. We added the median yearly growth rate and the standard deviation of the growth rate.

The standard deviation of the growth rate helps us understand which components are the most volatile or dynamic over 9 years of budgets. The higher the number, the higher the dynamic nature. For example, “All Other” revenue has the highest standard deviation (0.38) and is the most dynamic due to the lumpy nature of how we receive Federal funding, especially ARPA funding. 19A PILOT funding is the most consistent (Albany’s 19A funding is unchanged over 9 years at $15 million/year) and the standard deviation is therefore 0.00. Try sorting the table by Median or Standard Deviation.

| Revenue Item | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | Median Yearly Growth Rate | Standard Deviation of Growth Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| State Aid | 10% | 3% | 6% | -3% | -1% | 1% | 0% | 0% | 1% | 0.04 |

| Capital City Funding | 33% | 0% | 0% | 20% | 0% | 0% | 0% | 0% | 0% | 0.12 |

| 19A Pilot | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.00 |

| Sales & Use Tax | 3% | 4% | 22% | 8% | -3% | 6% | 3% | -2% | 3% | 0.07 |

| Property Tax | 2% | 2% | 2% | 0% | 2% | 1% | 0% | 1% | 1% | 0.01 |

| Other PILOTS & Taxes | 14% | -5% | 18% | -13% | 3% | 35% | -37% | 6% | 5% | 0.20 |

| Landfill Income | 27% | -11% | 15% | -49% | -1% | 2% | -1% | -17% | -1% | 0.21 |

| Departmental Income | 41% | -1% | 7% | 0% | 5% | 4% | 2% | 4% | 4% | 0.13 |

14 Thoughts & Questions from the Budget Data

1. Budget compared to CPI & Inflation

We started with a basic question - is the increase in the size of Albany’s budget reasonable?

Albany’s budget in 2017 - $176,982,803

Albany’s budget in 2025 - $221,256,965

Growth in Albany’s budget between 2017 and 2025 - 25%

There are two measures that we can use for comparison - inflation and consumer price index (CPI). The overall inflation rate between 2017 and 2025 is roughly 29% depending upon the months you pick as the start and finish. The overall growth in the consumer price index between 2017 and 2025 is approximately 28%, varying based on start/end month. We can view as a a positive that Albany’s budget has grown at a slower rate than inflation and the CPI

2. Federal revenue spikes

The Cov19 impact and related Federal funding (driven by American Rescue Plan Act funding) shows a 2023 spike and make year to year comparisons difficult. Federal funding falls under the “All Other” line which looks like this for the past 5 years:

2021 = $12,586,140

2022 = $20,609,208

2023 = $32,318,242

2024 = $38,800,943

2025 = $14,927,476

With this spike and subsequent decline we do need to be careful in how we examine and draw conclusions from trends.

3. Missing narratives - Inter-fund Transfers and Appropriated Debt Reserve

While Albany’s budget narratives present detail and context on the budget in a generally understandable fashion, the “Inter-fund Transfers” and “Appropriated Debt Reserve” (2020-2022) are budget lines that require more context on what they are or were.

4. Constant Revenue sources

There are three categories of revenue that have remained unchanged or are very predictable over 9 years.

- 19A PILOT funding (payments from NY State for the Empire State Plaza) have been a constant $15 million

- Capital City funding (payments to make up for AIM shortcomings) have had several step changes - $12.5 million between 2017-2021, $15 million between 2022-2024 and the 2025 budget predicts a $20 million revenue stream

- Property tax revenue has grown 9% between 2017 and 2025, with recent years (2023-25) showing most of the growth

5. Comparing Albany’s budget vs. peers and neighbors

Comparing budgets between two cities can be an apples and oranges exercise (or maybe a honey crisp apple vs. a granny smith apple comparison). Cities are different, their populations and needs are different and we don’t want to infer too much in our comparisons. However we can look at some basic data. Let’s look at Albany versus a few neighbors and upstate peers. We will use budget dollars per capita as our comparison metric.

| City | Population (1000s) | Budget ($ millions) | Budget $/capita |

|---|---|---|---|

| Albany | 101 | $221 | $2188 |

| Troy | 50 | $112 | $2240 |

| Syracuse | 148 | $341 | $2304 |

| Rochester | 207 | $539 | $2603 |

All cities are in the same ballpark and Albany is the lowest per capita spend of these four cities. In a separate article we examine the inequities in AIM funding; Syracuse and Rochester receive more AIM funding on a per capita basis than Albany which may drive some portion of their higher per capita spending.

6. Highly variable revenue - Landfill income

Landfill income is the second most dynamic revenue stream when viewed on a year over year basis for the 9 years of this study. We can look at growth rates (positive and negative) year over year. The table shows year over year landfill income growth in green, decline in red.

| Year | Year over Year growth or decline |

|---|---|

| 2025 | 27% |

| 2024 | -11% |

| 2023 | 15% |

| 2022 | -49% |

| 2021 | -1% |

| 2020 | 2% |

| 2019 | -1% |

| 2018 | -17% |

A projected 27% growth rate in 2025 Landfill Income ($3.23 to 4.11 million from 2024 to 25) represents an unprecedented growth rate. There is little information in the narrative that describes the expected factors driving this growth. We would want to see more detail to understand if this is a realistic growth number.

7. Highly variable revenue - Other PILOT and Taxes

Other PILOTs and Taxes revenue is expected to grow by 14%, from $6.3 to $7.2 million. There is little information in the narrative that describes the expected factors driving this growth. We would want to see more detail to understand if this is a realistic growth number. The table below shows year over year PILOT income growth in dark and light green, decline in red and yellow.

| Year | Year over Year growth or decline |

|---|---|

| 2025 | 14% |

| 2024 | -5% |

| 2023 | 18% |

| 2022 | -13% |

| 2021 | 3% |

| 2020 | 35% |

| 2019 | -37% |

| 2018 | 6% |

In addition, the City of Albany’s Cannabis Excise taxes fall in this “Other PILOT and Taxes” revenue category. From the budget narrative, there is a significant increase in revenue for 2025.

- 2023 Actual Cannabis Excite Tax Revenue - $30,535

- 2024 Adopted Cannabis Excite Tax Revenue - $125,000

- 2025 Proposed Cannabis Excite Tax Revenue - $500,000

A 4X Cannabis excise tax revenue increase draws our attention. This is a brave new world and we would expect that these projections are educated guesses OR we would want to understand the analysis that suggests this growth, whether City or New York State analysis.

8. Departmental Income

Departmental Income is expected to grow from $17.87 to $25.19 million, a 41% growth rate of $7.32 million. We attempted to unpack what is behind this growth in the 2025 budget. We found several revenue lines that represent 6 figure growth (e.g. “DGS Fees” will grow from $550k to $800k, “Code Violations Court” grows from $86k to $225k).

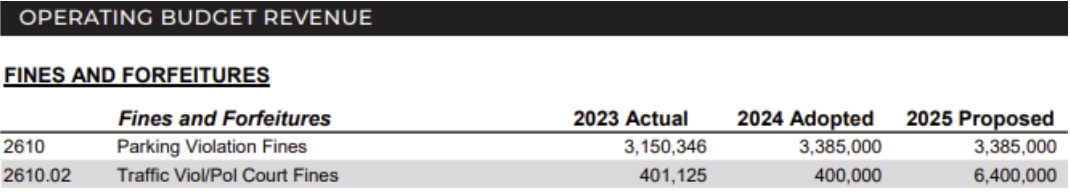

We did find that “Traffic Viol/Pol Court Fines” shows a projected $6 million increase. The budget narrative does not call out that “Fines and Forfeitures” falls under Departmental Income, however it is the best explanation. Our assumption is that this revenue increase is all driven by the introduction of school-related speed cameras. Note that we can see a quote in the Times Union that the Mayor added $6 million revenue in the budget for the speed camera program; we would expect that this commentary should show up in the budget narrative.

In any industry or level of government, new revenue streams of any type are exceptionally challenging to project accurately. For the school speed camera program payment rates, growth or decline of violators, and decisions that the City makes on the minimum threshold to issue a ticket will all impact how much revenue this program will generate.

9. Expenses - Wages

Wages have grown by 32% between 2017 and 2025, compared to the overall budget growth rate of 25%. Year over year growth rates are variable, presumably timed with collective bargaining cycles and any retroactive payments. The table below shows year over year higher growth in yellow, with years of lower wage growth in neutral color.

| Year | Year over Year growth or decline |

|---|---|

| 2025 | 3% |

| 2024 | 6% |

| 2023 | 10% |

| 2022 | 4% |

| 2021 | 2% |

| 2020 | 1% |

| 2019 | 4% |

| 2018 | -2% |

Reviewing the Wages in isolation is interesting, however we would want to see the full time employee count. Has overall staffing gone up or down? The most interesting number to us is how have wages increased on a per employee basis?

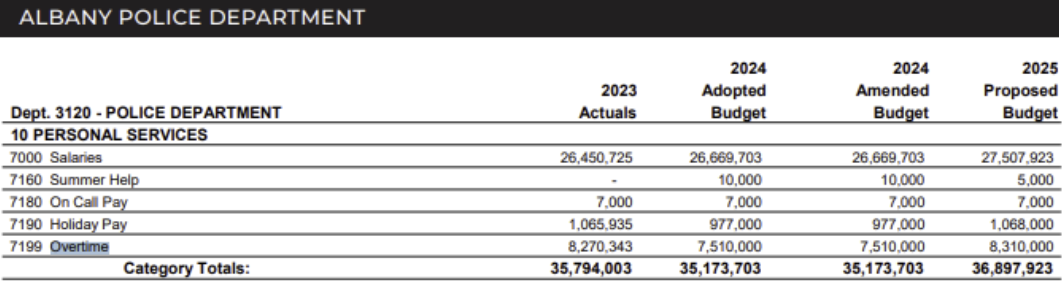

10. Expenses - Police Department Overtime

The Albany Police Department has a known shortfall of full time officers. There is a single comment in the 2025 Budget narrative about closing this gap:

“Launched the Join Albany Public Safety hiring campaign, including developing lateral hiring policies, a dedicated web page, and APD digital marketing campaign.”

It is beyond the scope of this article to suggest strategies for closing this gap, however we can examine one potential impact of staffing shortfalls. Overtime represents 22.5% of the Police Department wage budget ($8.31 million out of $36.9)

Not all APD overtime is driven by staffing shortfalls. Here are some starter questions:

- What portion of APD overtime is driven by staffing shortfalls?

- For staffing-related overtime what is the long-term impact to retention?

- For staffing-related overtime what is the long-term budgetary impact for retirement spending?

- What is the potential to shift overtime expenses into efforts that drive recruitment and retention?

11. Retirement Expenses and their predictability

When we examine retirement expenses we noted that the last few years have seen significant volatility. Year over year retirement expense growth is in red and yellow, the single year with retirement expense decline is in light green.

| Year | Year over Year growth or decline |

|---|---|

| 2025 | 5% |

| 2024 | 10% |

| 2023 | 13% |

| 2022 | 1% |

| 2021 | 7% |

| 2020 | 10% |

| 2019 | -8% |

| 2018 | 1% |

There is little information in the Budget narrative that explains the 2025 projected spending. We would want to understand what is driving these changes. In addition, we would like to see a projection for future Retirement expenses and what the rates of growth will look like.

12. Health Insurance & other benefits

One of the bigger surprises was to see the consistency in Health Insurance & Other Employee Benefits. In a time where news reports describe double digit health insurance increases (for employers and employees) we were not expecting only a 2% growth in this category. The table below shows year over year wage health insurance growth; the single year with exceptional growth is in yellow, the single year with exceptional decline is in light green.

| Year | Year over Year growth or decline |

|---|---|

| 2025 | 2% |

| 2024 | 5% |

| 2023 | -4% |

| 2022 | 0% |

| 2021 | 3% |

| 2020 | 1% |

| 2019 | 1% |

| 2018 | 0% |

Health insurance represents 8% of City budget so this is an important number. Is the slow rate of increase due to lower staffing, year over year? Is the benefit package shrinking? Are City employees paying a larger portion of costs? This is information that would be important to see in the Budget narrative.

13. Highly variable expenses - Debt service

Albany’s Debt Service is the most volatile expense, year over year, when measured by growth rate standard deviation. The table below shows the year over year growth or decline in the debt service. Year over year growth in debt service is in yellow and red; decline is displayed in light and dark green.

| Debt Service | Year over year growth or (decline) |

|---|---|

| 2025 | 9% |

| 2024 | -23% |

| 2023 | 18% |

| 2022 | -4% |

| 2021 | -24% |

| 2020 | 24% |

| 2019 | -12% |

| 2018 | -1% |

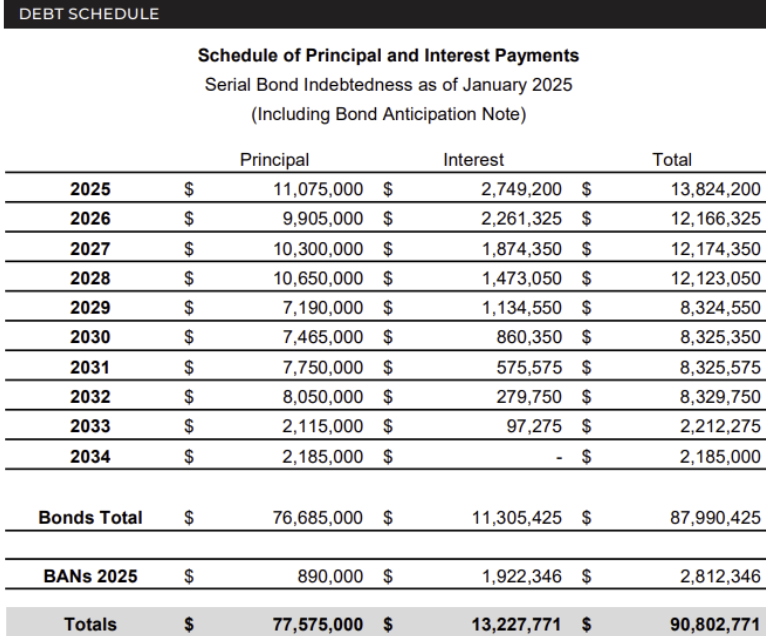

Public debt is not a bad thing, it is how we build infrastructure. We do want to understand what the debt is for. The budget narrative has a table showing the principal and interest payments which is a good start; it would be illuminating to have a companion table that shows the puts and takes of debt.

In our personal lives if we pay a car loan, a credit card payment, or a mortgage payment we can put cause and effect together - we paid for a trip on a credit card and now the bill comes due.

14. Albany for All - Unpacking the spending

Albany for All represents the distribution of American Rescue Plan Act (ARPA) funding through grants focused on housing, community spaces and direct services. We are excited to see the positive impact in all of those areas. Albany for All shows up in 3 budget years of expenditures:

- 2023 - $10 million

- 2024 - $12 million

- 2025 - $2 million

The Budget narrative describes the program status:

"The Albany for All initiative was launched, with those priorities in mind, to invest $25 million of funding directly into the community. Through a rigorous selection process, city officials ultimately chose to fund 35 projects that would be highly impactful and transformative for the community. As the city approaches the halfway point of the initiative, the various projects are already demonstrating positive impacts in the community with much more progress still on the way"

The Budget narrative also describes some of the operational practice associated with the program:

"Continued to manage administration of the $25 million Albany for All program, preparing quarterly reports to U.S Treasury Department, managing all grant reimbursements, and collecting program data."

This brings up a few questions:

- The total Albany for All spending between 2023-25 is $24 million and the narrative suggests the total program is $25 million. Is there an additional $1 million that will be in the 2026 budget?

- Can the City distribute a comprehensive list of the 35 programs and the allocation of Albany for All spending on each program between 2023 to 2025?

- Has the $2 million in the 2025 budget for Albany for All been allocated already or is this in progress? There is some indication that the West Hill’s new community center (opening Fall 2025) could be the recipient of the funding, is this one target for the 2025 spending?

Data

For this article we referenced budget files from 2017-2024 found in the City of Albany Budget Office portal. We exclusively utilized Adopted Budgets.

Download the spreadsheet of compiled information that we used in our analysis.

Revenue information was found and copied from the "2025 Revenue Breakdown" found in the "BUDGET SUMMARY OF REVENUE & EXPENDITURES" sections, e.g. page 8 in the 2025 Adopted Budget. Expense information was found and copied from the "2025 Expenditure Breakdown", typically found on the next page in the Budget. After data entry, we used the "BUDGET SUMMARY" chart and the General Fund Revenues and Expenditures to vertify data input.

We found only a single issue. In 2020 there is a small discrepency in the 2020 budget's Total Revenue. This is noted in cell J8 of the "Budgets" sheet.

Note:

- The "Inter-Fund Transfers" line item is only found in the 2023-2025 budgets

- The "Appropriated Debt Reserve" line item is only found in the 2020-2022 budgets

- The "Federal Aid" line item found only in the 2024-2025 budgets is combined into the "All Other (includes Federal Aid for 2024 & 2025)" line item

Process

We created several additional metrics and data points to assist us in analyzing the budget, all found in the "Budgets" sheet:

- "2017 to 2025 Growth" - column N - we wanted to understand the growth of any revenue or expense line between 2017 and 2025. This formula shows the growth over the years (2025 value / 2017 value) - 1, expressed as a Percentage

- "Revenue Growth/Loss, Year over year" - table P11:X24 - we wanted to look at the yearly change for any Revenue line. Each cell is a basic formula that reviews the growth in a line by year (e.g. Property Tax, 2021) and compares that against the previous year (Property Tax, 2020). In addition, we used Conditional Formatting > Color Scales > Green|White|Red to make the visualization of extreme values more easy to spot

- "Median Yearly Growth Rate" - Column Z - we reviewed the Growth/Loss values for any line and analyzed the Median Growth/Loss values which helped us understand the year-to-year stability or volatility of any Revenue or Expenditure line

- "Standard Deviation of Growth Rate" - column AA - we reviewed the Growth/Loss values for any line and analyzed the Standard Devation of this growth. This helps us tease out the lines that show extreme fluctuations year-to-year, for example Federal Aid has wide yearly swings, while 19A PILOT income from NY State has been statistic for 9 years

Credits

This data story and its content is available under the Creative Commons Attribution license.

Persons or organizations that Share or Adapt this content should provide Attribution that provides appropriate credit, which includes:

- © Copyright 2025

- Tyche Insights, P.B.C.

- KarlTyche (Karl Urich)

For example, a data product or service that utilizes this article could include attribution such as:

"Portions derived from 'Albany NY Budget', © Copyright 2025 by Tyche Insights, P.B.C., KarlTyche (Karl Urich) & licensed under the CC BY 4.0 license"